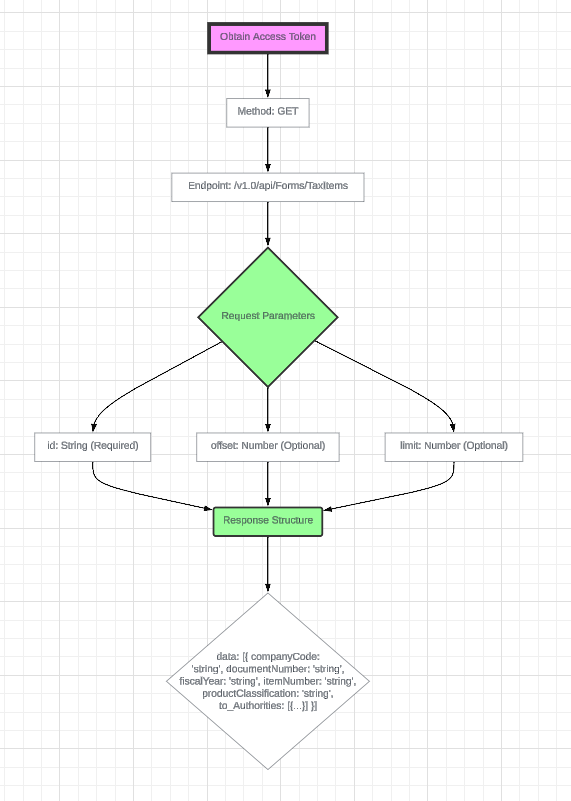

GET TaxItems

Description

This endpoint retrieves additional data from tax items that were previously uploaded into the system.

Endpoint

• Endpoint: <environment base url>/v1.0/api/Forms/TaxItems

• Method: GET

Request Structure

| Parameter | Type | Required |

|---|---|---|

| id | String | Yes |

| offset | Number | No |

| limit | Number | No |

Response Structure

{

"data": [{

“companyCode”: “string”,

“documentNumber”: “string’,

“fiscalYear”: “string”,

“itemNumber”: “string”,

“productClassification”: “string”,

“to_Authorities”: [{

“levelSAP”: “1”,

“taxJurisdictionLevel”: “1”,

“taxJurisdictionLevelCode”: “DI”,

“taxJurisdictionForCalc”: “FULTON”,

“taxJurisdictionForReporting”: “GEORGIA”,

“baseAmount”: “100.00”,

“taxRate”: “0.25”,

“taxAmount”: “25.00”

}

]

}

]

}

Tax Jurisdiction Code -- Possible Values

| Code | Value |

|---|---|

| ST | State |

| CO | County |

| CI | City |

| DI | District |

| LO | Local |

| L1 | Local / City |

| L2 | Local / County |

| L3 | Local / District |

API Contract

- The same X-Request-ID sent on the upload request should be provided in the "id" parameter, and all the tax items uploaded by the corresponding upload process are returned.

- A single tax item can be assigned multiple Authority levels.

- The endpointcontains paging capabilities so the requests can be fragmented to avoid performance issues limit and offset parameters will be used to handle pagination.

- JSON compression with gzip is supported to reduce the payload response size and improve performance.

Sample Response

{

"data": {

"requestStatus": "Completed",

"formInstances": [

{

"id": "fda7826d-5188-4717-8aef-626e70dd831f",

"responses": [

{

"status": "In Process",

"timestamp": "4/19/2024 3:30:08 AM",

"message": "[{\"Message\":\"Invalid value at \\\"Tax Payer ID\\\":\\\"DJS12345\\\". Value must be 8 digits.\",\"PdfElementName\":\"Tax Payer ID\",\"XmlAttributeName\":\"\"},{\"Message\":\"TAXPAYER ELECTRONIC FILING SIGNATURE CODE is required.\",\"PdfElementName\":\"TAXPAYER ELECTRONIC FILING SIGNATURE CODE\",\"XmlAttributeName\":\"\"}]",

"responseFileId": "",

"requestFileId": ""

},

{

"status": "SGF",

"timestamp": "4/19/2024 3:40:03 AM",

"message": "[{\"Message\":\"Invalid value at \\\"Tax Payer ID\\\":\\\"DJS12345\\\". Value must be 8 digits.\",\"PdfElementName\":\"Tax Payer ID\",\"XmlAttributeName\":\"\"},{\"Message\":\"TAXPAYER ELECTRONIC FILING SIGNATURE CODE is required.\",\"PdfElementName\":\"TAXPAYER ELECTRONIC FILING SIGNATURE CODE\",\"XmlAttributeName\":\"\"}]",

"responseFileId": "",

"requestFileId": ""

}

]

}

]

}

}

Sample request [CURL]

curl --location 'https://testsuretaxapi.taxrating.net/v1.0/api/Forms/TaxItems?id=37BAC21C94331EDE9499576224B6&offset=100&limit=100' \

--header 'Authorization: Bearer <access_token_value>'