POST TaxItems

Description

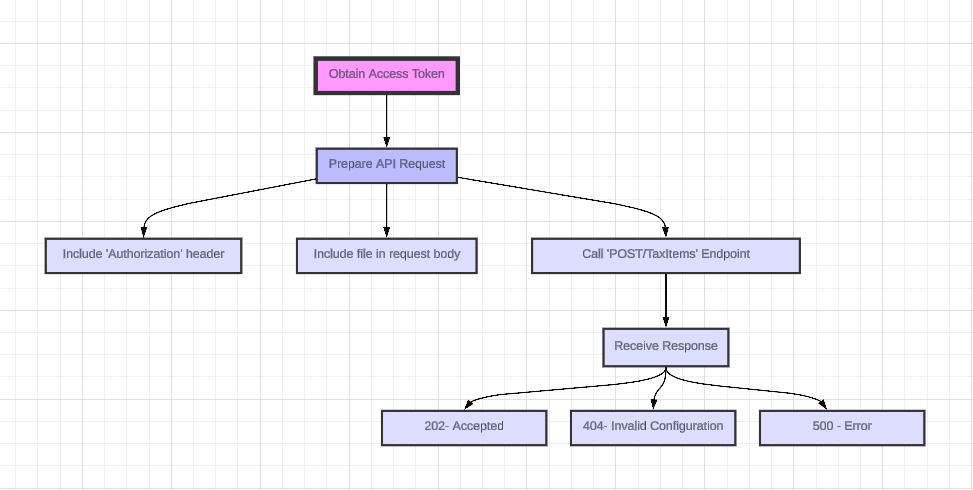

This API endpoint enables upload of transactions from the external tax system into SureTax, facilitating further processing and generation of forms. By triggering this endpoint, users can seamlessly upload tax-related data, enabling the external system to perform additional processing tasks and generate necessary forms as required. This functionality streamlines the data exchange process, enhancing efficiency and accuracy in tax-related operations.

Endpoint

• Endpoint: <environment base url>/v1.0/api/Forms/TaxItems

• Method: POST

Request Body

The request will be sent using the multipart/form-data method, with the parts structured as shown below:

| Content-Disposition | Content Type | Required |

|---|---|---|

| form-data; name="requestData" | application/json | Yes |

| form-data; name="FileContent"; filename="filename.csv" | text/csv | Yes |

Request Data

{

"externalReportingEntity": "string",

"fileLayaoutVersion": "string"

}

Response Structure

No response in case of success. The success HTTP status code will identify if the job was created successfully or not.

The response structure in case of errors.

Sample Request

httpCopy code

`POST

-- BOUNDARY

Content-Disposition: form-data; name="requestData"

Content-Type: application/json {"externalReportingEntity": "string", "fileLayoutVersion": "string"}

-- BOUNDARY

Content-Disposition: form-data; name="FileContent"; filename="37BAC21C94331EDE9499576224B64C81.csv"

Content-Type: text/csv API Contract CSV File Layout

Field

Data Type

Specifications

Company Code

String

maxLength: 4

Document Number

String

maxLength: 32

Fiscal Year

Number

(4)

Item Number

Number

(6)

Reporting Date

Date

(YYYYMMDD)

United States Tax Category

String

maxLength: 1

Material Number

String

maxLength: 40

Material Description

String

maxLength: 60

Material Group

String

maxLength: 20

Ship-From State

String

maxLength: 3

Ship-From County

String

maxLength: 40

Ship-From City

String

maxLength: 40

Ship-From Address

String

maxLength: 80

Ship-From Zip Code

String

maxLength: 10

Ship-To State

String

maxLength: 3

Ship-To County

String

maxLength: 40

Ship-To City

String

maxLength: 40

Ship-To Address

String

maxLength: 80

Ship-To Zip Code

String

maxLength: 10

Location ID

String

maxLength: 16

Gross Amount

Decimal

maxLength: 23, decimals: 2

Tax Rate

Decimal

maxLength: 23, decimals: 3

Taxable Base

Decimal

maxLength: 23, decimals: 2

Level 1 Tax

Decimal

maxLength: 23, decimals: 2

Level 1 Exemption Reason Code

String

maxLength: 2

Level 1 Exemption Amount

Decimal

maxLength: 23, decimals: 2

Level 2 Tax

Decimal

maxLength: 23, decimals: 2

Level 2 Exemption Reason Code

String

maxLength: 2

Level 2 Exemption Amount

Decimal

maxLength: 23, decimals: 2

Level 3 Tax

Decimal

maxLength: 23, decimals: 2

Level 3 Exemption Reason Code

String

maxLength: 2

Level 3 Exemption Amount

Decimal

maxLength: 23, decimals: 2

Level 4 Tax

Decimal

maxLength: 23, decimals: 2

Level 4 Exemption Reason Code

String

maxLength: 2

Level 4 Exemption Amount

Decimal

maxLength: 23, decimals: 2

Level 5 Tax

Decimal

maxLength: 23, decimals: 2

Level 5 Exemption Reason Code

String

maxLength: 2

Level 5 Exemption Amount

Decimal

maxLength: 23, decimals: 2

Level 6 Tax

Decimal

maxLength: 23

Sample Response

HTTP 201 code is returned and empty body

Sample request [CURL]

curl --location 'https://testsuretaxapi.taxrating.net/v1.0/api/Forms/TaxItemsUpload' \

--header 'X-Request-Id: 0630A823-93BD-4021-800B-0003862FE2EB' \

--header 'Authorization: Bearer <access_token_value>' \

--form 'fileContent=@"/C:/user/files/4lns0523.csv"' \

--form 'requestData="{\"externalReportingEntity\":\"A000420001\",\"fileLayoutVersion\":\"1\"}"'