CCH® SureTax® v1.0 for Microsoft Dynamics NAV User Guide

Updated: August 4, 2017

CCH® SureTax® for Microsoft Dynamics NAV User Guide

Welcome to CCH® SureTax®

CCH SureTax for Dynamics NAV is a plug-in for Dynamics NAV that helps you accurately calculate sales tax for the United States and Canada. The plug-in includes components that can be purchased and installed separately:

- The Sales & Marketing component works with the Sales & Marketing module of Dynamics NAV.

- The Purchasing component integrates with the Purchase module of Dynamics NAV.

- The Services component integrates with the Purchase module of Dynamics NAV.

- CCH SureAddress helps you accurately validate addresses throughout the Sales & Marketing, Purchasing, and Services modules.

Scope of this User Guide

This guide provides guidance for staff members who work with Dynamics NAV Sales & Marketing and Purchase modules on a day-to-day basis. It assumes that the reader knows how to find and open common forms in these Dynamics NAV modules. Information about using Dynamics NAV forms is limited to specific instructions for using the CCH SureTax features on those forms.

Conventions Used in this Guide

To help you locate and interpret information, consistent visual cues and a standard vocabulary are used throughout this guide. These conventions are described below.

- Bold facing is used in procedures to indicate a specific item in the program that you must select, enter, or otherwise act upon. For example: Click Finish to exit the wizard.

- The greater-than symbol (>) is used to indicate the sequence of menus or folders to navigate through to reach a particular location. For example: Select Sales & Marketing > Order Processing > Orders to open the sales order form.

- Italics are used to identify the names of the forms, tabs, sections of forms, and fields. For example: In the Default order-approval address section, enter the address to be used for order approvals.

To distinguish between the subparts that make up the SureTax plug-in and Dynamics NAV, different labels are applied to these items. The word "component" is used to identify subparts of the SureTax plug-in, while the word "module" is used to describe subparts of Dynamics NAV.

Chapter 1 - Installation and Basic Configuration

Overview

CCH SureTax for Microsoft Dynamics NAV is a plug-in that integrates the CCH SureTax solution with Microsoft Dynamics NAV. With CCH SureTax Sales Component for Microsoft Dynamics NAV installed, you can accurately calculate sales tax for the United States and Canada, as well as VAT, and manage your sales tax compliance without the need to maintain sales tax rates inside Dynamics NAV.

The CCH SureTax for Microsoft Dynamics NAV product includes three components that can be installed separately:

- Sales & Marketing: Allows you to manage your sales tax compliance in the Sales & Marketing module of Dynamics NAV.

- Purchasing: Allows you to manage your sales tax compliance in the Purchase module of Dynamics NAV.

- Services: Allows you to manage your sales tax compliance in the Services module of Dynamics NAV.

- SureAddress: Allows you to validate addresses in the Sales & Marketing, Purchasing, and Services modules.

How It Works

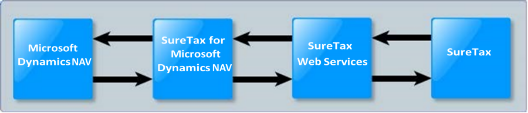

When you compute the sales tax on a transaction in Microsoft Dynamics NAV, the CCH SureTax for Microsoft Dynamics NAV plug-in sends the transaction information from Dynamics NAV through SureTax Web Services to the main CCH SureTax application. The calculated sales tax is sent back to Dynamics NAV through SureTax Web Services. If needed, you can view the results of the CCH SureTax calculation from the Microsoft Dynamics NAV Temporary Sales Transactions form before posting the transaction.

Figure 1: Information flow when using the CCH SureTax for Microsoft Dynamics NAV plug-in.

Figure 1: Information flow when using the CCH SureTax for Microsoft Dynamics NAV plug-in.

Features

With CCH SureTax for Microsoft Dynamics NAV, you can do the following:

- Supports the Microsoft Dynamics NAV Windows and web clients.

- Manage sales tax for transactions created on any of the following Microsoft Dynamics NAV forms:

- Sales & Marketing Forms

- Sales Quote

- Sales Order

- Sales Invoice

- Blanket Sales Order

- Sales Return Order

- Sales Credit Memo

- Sales Order Shipment

- Sales Order Invoice

- Purchase Forms

- Purchase Quote

- Purchase Invoice

- Blanket Purchase Order

- Purchase Return Order

- Purchase Credit Memo

- Services

- Service Quote

- Service Order

- Service Invoice

- Service Return Order

- Service Credit Memos

- Sales & Marketing Forms

- Input multiple addresses for each line item in a transaction.

- Select exemptions at the line-item level.

- Select different posting accounts for each state as needed using the state-level tax area codes.

- Display detailed results of the sales tax calculation from the Microsoft Dynamics NAV Statistics form.

- Import system data through CCH SureTax Web services.

Limitations

The following are limitations of the CCH SureTax for Microsoft Dynamics NAV plug-in:

- CCH SureTax calculates tax for the United States and Canada only.

- The State field on all addresses cannot be more than two characters long.

Installing the CCH SureTax for Microsoft Dynamics NAV Plug-Ins

CCH SureTax for Microsoft Dynamics NAV has four modules available:

- Sales: Provides tax calculation for transactions processed through the Sales & Marketing module in NAV.

- Purchase: Provides tax calculation for transactions processed through the Purchasing module in NAV.

- Service: Provides tax calculation for transactions processed through the Service module in NAV.

- AV: Provides address validation for the Sales & Marketing, Purchasing, and Service modules in NAV.

We Recommend: Back up all Dynamics NAV objects that the plug-in modifies before importing the customization files. A list of the objects that will be modified can be found in the Appendix.

Note: If you are installing both the AV plug-in and any tax calculation plug-in, install the AV plug-in first.

Before importing the customization code, the NAV license must have the CCH granules added through Partnersource.

Each plug-in module except for AV contains two sets of code files. One set, STXBase, contains objects that are common among all the plug-in modules (except AV). These files are the same for each module and only must be imported once if multiple modules are installed. The second set contains code specific to each module. There is no requirement on the order that objects are imported. Each set of code files consists of one FOB file and one TXT file. The FOB file contains compiled code, and we recommend that you import the code in this format whenever possible. The TXT file contains raw text, which can be useful when code merging is required for native NAV objects.

We recommend that you perform database synchronization during import, and that you perform a full compile of all imported objects after the import. Plug-in objects can be filtered in the Object Designer by filtering on the Version List field with a value of CCH.

Basic Setup

The following sections contain information about the basic setup that you must perform before you can use CCH SureTax for Microsoft Dynamics NAV to calculate sales tax.

Before You Set Up

We recommend that you review the information in this section before attempting to set up the CCH SureTax for Microsoft Dynamics NAV plug-in.

Configuring Company-Level Settings

The CCH Setup form allows you to configure the CCH SureTax for Microsoft Dynamics NAV settings that apply for the company.

To configure plug-in settings, do the following:

Select Departments, and then select CCH SureTax > Administration > CCH Setup. The CCH Setup form displays.

Select the General tab and configure the following settings:

- Tax Validation Key: Enter the Validation Key for SureTax tax calculation requests.

- Tax Client ID: Enter the Client ID for SureTax tax calculation requests.

- Address Validation Key: Enter the Validation Key for SureAddress address validation requests.

- Address Client ID: Enter the Client ID for SureAddress address validation requests.

- Data API URL: Enter the URL for importing CCH SureTax system data.

- Address Validation URL: Enter the URL for SureAddress address validation requests.

- SureTax Request URL: Enter the URL for CCH SureTax tax calculation requests.

- Enable for Sales: Enable CCH SureTax for Sales transactions.

- Enable for Purchases: Enable CCH SureTax for Purchases transactions.

- Enable for Services: Enable CCH SureTax for Services transactions.

- SureTax Tax Area Code Prefix: Configure the Prefix for SureTax Tax Area Codes.

- SureTax Tax Group Code: Configure the Tax Group Code for SureTax.

- We Recommend: We recommend that you create a new Tax Group code specifically for the CCH SureTax plug-in.

- Min. Address Validation Score: Configure the minimum Address Validation score for returned matching addresses.

- Disable Automatic Tax Calc: Select whether to Disable or Enable automatic tax calculation.

- We Recommend: We recommend disabling automatic tax calculation to improve performance.

Select the Logging tab and configure the Enable SOAP Tracing setting. This setting is used for troubleshooting.

Select the Default tab and configure the following settings:

- Tax Account (Sales): Configure default Tax Account for Sales.

- Tax Account (Purchase): Configure default Tax Account for Purchase.

- Reverse Charge (Purchase): Configure default reverse charge account for purchase.

Close the setup form.

Select Departments, and then select CCH SureTax > Administration > CCH Setup > CCH Load Subsidiary Data. The system data necessary to use the plug-in will load.

Close the form.

Select Departments, and then select CCH SureTax > Administration > CCH Setup. The CCH Setup form displays.

Select the Default tab and configure the following settings:

- Regulatory Code: Select default regulatory code.

- Sales Type Code: Select default Sales type code.

- Transaction Type Code: Select default Transaction type code for transactions.

- Tax Situs Rule: Select default Tax Situs Rule for Transactions.

Close the form to save the company settings.

Update the Tax Area Code for all customers to a CCH SureTax Tax Area Code.

Update the Tax Group Code for all Items to the CCH SureTax Tax Group Code.

Chapter 2 - Using CCH SureAddress Individual Address Validation

You can perform individual address validation with this plug-in on various forms in Dynamics NAV.

- For supported forms, you can validate individual addresses by clicking Actions > Address Validation, or by clicking Save for automatic validation. The CCH Address Validation card displays showing the Original and Validated Address.

- Click Accept to accept the validated address, or click Reject to continue with the Original Address.

Chapter 3 - Configuring and Using the Sales Component

Overview

The Sales component of the CCH SureTax for Microsoft Dynamics NAV plug-in integrates with the Dynamics NAV Sales module. The Dynamics NAV Sales forms for which CCH SureTax can calculate tax are as follows:

- Quotes

- Orders

- Blanket Orders

- Return Orders

- Invoices

- Credit Memos

- Sales Order Shipping

- Sales Order Invoicing

The first half of this chapter explains how to configure the options that impact the Sales component. The setup process includes setting defaults on some standard Dynamics NAV forms.

The second half of the chapter, titled Using the Sales Component, includes information about using CCH SureTax options when entering transactions into Microsoft Dynamics NAV. This section also describes how to view sales taxes prior to posting and how to post the sales tax transactions.

Configuring the Sales Component

Before using the Sales component of the plug-in, you first must do the following:

- Set default values for CCH SureTax:

- Customer form: On this form, you can set the sales tax options for specific customers as needed. See Setting CCH SureTax Options for a Customer on the next page for more information.

- Item form: On this form you can set the CCH SureTax options for specific items as needed. See Setting CCH SureTax Options for Items on the next page for more information.

Setting CCH SureTax Options for a Customer

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV Customer card. Use the following procedure to override the CCH SureTax sales type code for specific Dynamics NAV customer accounts.

- Open the customer card for the customer that you are modifying settings for.

- Expand the Invoicing tab.

- In the SureTax section, select options for the following field:

- Sales Type Code: Your selection will override the default Sales type code selected on the CCH Setup form on transactions for this customer.

- Close the customer card to save your changes.

Setting CCH SureTax Options for Items

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV items form. Use the following procedure to set the CCH SureTax transaction type code for specific Dynamics NAV items.

- Open the Item card for the item that you are modifying settings for.

- Expand the Item tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this item.

- Close the Item card to save your changes.

Settings CCH SureTax Options for G/L Accounts

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV G/L Account card. Use the following procedure to set the CCH SureTax transaction type code for a specific Dynamics NAV G/L account.

- Open the G/L account that you are modifying settings for.

- Expand the General tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this G/L account.

- Close the G/L Account card to save your changes.

Settings CCH SureTax Options for Resources

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV Resources card. Use the following procedure to set the CCH SureTax transaction type code for a specific Dynamics NAV Resource.

- Open the Resource that you are modifying settings for.

- Expand the General tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this Resource.

- Close the Resource card to save your changes.

Settings CCH SureTax Options for Fixed Assets

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV Fixed Assets card. Use the following procedure to set the CCH SureTax transaction type code for a specific Dynamics NAV Fixed Asset.

- Open the Fixed Asset that you are modifying settings for.

- Expand the General tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this Fixed Asset.

- Close the Fixed Asset card to save your changes.

Settings CCH SureTax Options for Item Charges

When you install the plug-in, CCH SureTax settings are added to Dynamics NAV Item Charges. Use the following procedure to set the CCH SureTax transaction type code for specific Dynamics NAV Item charge.

- Select the Item Charge that you are modifying settings for.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this Item Charge.

- Close the Item Charge card to save your changes.

Using the CCH SureTax Features on Individual Sales Documents

When you create a sales document, the system applies the CCH SureTax settings that you selected on the Form of the item type, Customer, and CCH Setup form to the new document.

Using CCH SureTax Options with Dynamics NAV Features

The Dynamics NAV functions listed below either allow you to create a new document or line item based on an existing document or line item, or they allow you to quickly modify an existing document or line item. In some instances when you use these functions, the CCH SureTax options selected for the original document or line item may be retained on the new or modified item.

Setting CCH SureTax Options for Sales Transaction Lines

By default, CCH SureTax setting for transaction lines are defaulted from the CCH Setup form. These settings on the CCH Setup form can be overridden at the form of the corresponding Item type and Customer form. The Transaction type code defaults from the form of the corresponding Item Type.

Note: In the case of the "Item" item type, if the transaction type code on the Item card is not configured, then the plugin will pull the Transaction Type Code from the Item Category. The Sales Type Code defaults from the corresponding Customer form.

The CCH SureTax plugin allows you to override CCH SureTax settings at the line level on Sales & Marketing transactions. Do the following to configure CCH SureTax settings for individual lines on a Sales transaction.

- Select the transaction line for which to configure CCH SureTax settings.

- Select the Lines dropdown on the line items grid.

- Select Sales Tax Calculation.

- Configure the desired CCH SureTax settings for the line.

Viewing Sales Tax Details for Sales Documents

The CCH SureTax Tax Display form allows you to view detailed information about the sales tax for a document. To access this form, do the following:

- Open the sales document for which you want to display tax details.

- Select Sales Tax Results. The CCH Tax Results Document form opens. This form shows tax information sent to and returned from CCH SureTax at an order, line, and detail level. The information on this form cannot be edited.

- Do the following as needed to view tax details for a specific item:

- Details for specific line items are displayed in the Line Information grid. Scroll to the left or right as necessary to view line information details.

- To view tax details for a line item, select the line item. The tax grid will display the applicable tax information for the selected line item. Scroll to the left or right as necessary.

- Select Actions tab > View JSON in order to view the JSON of the CCH SureTax Request.

Calculating Tax Details for a Sale

Sales tax is calculated for a sale any time you perform one of the following tasks:

- Open the Dynamics NAV Statistics window for a sales document

- Print a sales document

- Release a sales document

- Post an order, invoice, return order, or credit memo

Note: If automatic tax calculation is disabled, tax will only be calculated when these events are performed.

Posting a Sales Document

When you post a sales order, return order, credit memo, or invoice, the plug-in finalizes the CCH SureTax transactions for the document.

Chapter 4 - Configuring and Using the Purchasing Component

Overview

The Purchasing component of the CCH SureTax for Microsoft Dynamics NAV plug-in integrates with the Dynamics NAV Purchasing module. The Dynamics NAV Purchasing forms for which CCH SureTax can calculate tax are as follows:

- Purchase Quotes

- Purchase Orders

- Blanket Purchase Orders

- Purchase Return Orders

- Purchase Invoices

- Purchase Credit Memos

The first half of this chapter explains how to configure the options that impact the Purchasing component. The setup process includes setting defaults on some standard Dynamics NAV forms.

The second half of the chapter, titled Using the Purchasing Component, includes information about using CCH SureTax options when entering transactions into Microsoft Dynamics NAV. This section also describes how to view use taxes prior to posting and how to post the use tax transactions.

Configuring the Purchasing Component

Before using the Purchasing component of the plug-in, you first must do the following:

- Set default values for CCH SureTax:

- Vendor form: On this form, you can set the use tax options for specific vendors as needed. See Setting CCH SureTax Options for a Vendor on the next page for more information.

- Item form: You can select the CCH SureTax options for specific items as needed. See Setting CCH SureTax Options for Items on the next page for more information.

- G/L account: On this form, you can set the use tax options for specific G/L accounts as needed. See Settings CCH SureTax Options for G/L Accounts on the next page for more information.

- Fixed assets: On this form, you can set the use tax options for specific Fixed assets as needed. See Settings CCH SureTax Options for Fixed Assets on the next page for more information.

- Item Charge: On this form, you can set the use tax options for specific Item Charges as needed. See Settings CCH SureTax Options for Item Charges on the next page for more information.

Setting CCH SureTax Options for a Vendor

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV Vendor card. Use the following procedure to override the CCH SureTax purchasing type code for specific Dynamics NAV vendor accounts.

- Open the vendor card for the vendor that you are modifying settings for.

- Expand the Invoicing tab.

- In the SureTax section, select options for the following field:

- Sales Type Code: Your selection will override the default Purchasing type code selected on the CCH Setup form on transactions for this vendor.

- Close the vendor card to save your changes.

Setting CCH SureTax Options for Items

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV items form. Use the following procedure to set the CCH SureTax transaction type code for specific Dynamics NAV items.

- Open the Item card for the item that you are modifying settings for.

- Expand the Item tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this item.

- Close the Item card to save your changes.

Settings CCH SureTax Options for G/L Accounts

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV G/L Account card. Use the following procedure to set the CCH SureTax transaction type code for a specific Dynamics NAV G/L account.

- Open the G/L account that you are modifying settings for.

- Expand the General tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this G/L account.

- Close the G/L Account card to save your changes.

Settings CCH SureTax Options for Resources

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV Resources card. Use the following procedure to set the CCH SureTax transaction type code for a specific Dynamics NAV Resource.

- Open the Resource that you are modifying settings for.

- Expand the General tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this Resource.

- Close the Resource card to save your changes.

Settings CCH SureTax Options for Fixed Assets

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV Fixed Assets card. Use the following procedure to set the CCH SureTax transaction type code for a specific Dynamics NAV Fixed Asset.

- Open the Fixed Asset that you are modifying settings for.

- Expand the General tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this Fixed Asset.

- Close the Fixed Asset card to save your changes.

Settings CCH SureTax Options for Item Charges

When you install the plug-in, CCH SureTax settings are added to Dynamics NAV Item Charges. Use the following procedure to set the CCH SureTax transaction type code for specific Dynamics NAV Item charge.

- Select the Item Charge that you are modifying settings for.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this Item Charge.

- Close the Item Charge card to save your changes.

Using the CCH SureTax Features on Individual Purchasing Documents

When you create a purchasing document, the system applies the CCH SureTax settings that you selected on the Form of the item type, Vendor, and CCH Setup form to the new document.

Using CCH SureTax Options with Dynamics NAV Features

The Dynamics NAV functions listed below either allow you to create a new document or line item based on an existing document or line item, or they allow you to quickly modify an existing document or line item. In some instances when you use these functions, the CCH SureTax options selected for the original document or line item may be retained on the new or modified item.

Setting CCH SureTax Options for Purchasing Transaction Lines

By default, CCH SureTax setting for transaction lines are defaulted from the CCH Setup form. These settings on the CCH Setup form can be overridden at the form of the corresponding Item type and Vendor form. The Transaction type code defaults from the form of the corresponding Item Type.

Note: In the case of the "Item" item type, if the transaction type code on the Item card is not configured, then the plugin will pull the Transaction Type Code from the Item Category. The Purchasing Type Code defaults from the corresponding Vendor form.

The CCH SureTax plugin allows you to override CCH SureTax settings at the line level on Purchasing transactions. Do the following to configure CCH SureTax settings for individual lines on a Purchasing transaction.

- Select the transaction line for which to configure CCH SureTax settings.

- Select the Lines dropdown on the line items grid.

- Select Use Tax Calculation.

- Configure the desired CCH SureTax settings for the line.

Viewing Use Tax Details for Purchasing Documents

The CCH SureTax Tax Display form allows you to view detailed information about the use tax for a document. To access this form, do the following:

- Open the purchasing document for which you want to display tax details.

- Select Use Tax Results. The CCH Tax Results Document form opens. This form shows tax information sent to and returned from CCH SureTax at an order, line, and detail level. The information on this form cannot be edited.

- Do the following as needed to view tax details for a specific item:

- Details for specific line items are displayed in the Line Information grid. Scroll to the left or right as necessary to view line information details.

- To view tax details for a line item, select the line item. The tax grid will display the applicable tax information for the selected line item. Scroll to the left or right as necessary.

- Select Actions tab > View JSON in order to view the JSON of the CCH SureTax Request.

Calculating Tax Details for a Purchase

Use tax is calculated for a purchase any time you perform one of the following tasks:

- Open the Dynamics NAV Statistics window for a purchasing document

- Print a purchasing document

- Release a purchasing document

- Post an order, invoice, return order, or credit memo Note: If automatic tax calculation is disabled, tax will only be calculated when these events are performed.

Posting a Purchasing Document

When you post a purchasing order, return order, credit memo, or invoice, the plug-in finalizes the transactions for the document.

Chapter 5 - Configuring and Using the Services Component

Overview

The Services component of the CCH SureTax for Microsoft Dynamics NAV plug-in integrates with the Dynamics NAV Services module. The Dynamics NAV Services forms for which CCH SureTax can calculate tax are as follows:

- Service Quotes

- Service Orders

- Service Invoices

- Service Credit Memos

The first half of this chapter explains how to configure the options that impact the Services component. The setup process includes setting defaults on some standard Dynamics NAV forms.

The second half of the chapter, titled Using the Services Component, includes information about using CCH SureTax options when entering transactions into Microsoft Dynamics NAV. This section also describes how to view service taxes prior to posting and how to post the service tax transactions.

Configuring the Services Component

Before using the Services component of the plug-in, you first must do the following:

- Set default values for CCH SureTax:

- Customer form: On this form, you can set the service tax options for specific customers as needed. See Setting CCH SureTax Options for a Customer on the next page for more information.

- Item form: On this form you can set the CCH SureTax options for specific items as needed. See Setting CCH SureTax Options for Items on the next page for more information.

Setting CCH SureTax Options for a Customer

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV Customer card. Use the following procedure to override the CCH SureTax sales type code for specific Dynamics NAV customer accounts.

- Open the customer card for the customer that you are modifying settings for.

- Expand the Invoicing tab.

- In the SureTax section, select options for the following field:

- Sales Type Code: Your selection will override the default Sales type code selected on the CCH Setup form on transactions for this customer.

- Close the customer card to save your changes.

Setting CCH SureTax Options for Items

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV items form. Use the following procedure to set the CCH SureTax transaction type code for specific Dynamics NAV items.

- Open the Item card for the item that you are modifying settings for.

- Expand the Item tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this item.

- Close the Item card to save your changes.

Settings CCH SureTax Options for G/L Accounts

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV G/L Account card. Use the following procedure to set the CCH SureTax transaction type code for a specific Dynamics NAV G/L account.

- Open the G/L account that you are modifying settings for.

- Expand the General tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this G/L account.

- Close the G/L Account card to save your changes.

Settings CCH SureTax Options for Fixed Assets

When you install the plug-in, CCH SureTax settings are added to the Dynamics NAV Fixed Assets card. Use the following procedure to set the CCH SureTax transaction type code for a specific Dynamics NAV Fixed Asset.

- Open the Fixed Asset that you are modifying settings for.

- Expand the General tab.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this Fixed Asset.

- Close the Fixed Asset card to save your changes.

Settings CCH SureTax Options for Item Charges

When you install the plug-in, CCH SureTax settings are added to Dynamics NAV Item Charges. Use the following procedure to set the CCH SureTax transaction type code for specific Dynamics NAV Item charge.

- Select the Item Charge that you are modifying settings for.

- Select options for each of the following fields:

- Transaction Type Code: Your selection will override the default Transaction type code selected on the CCH Setup form on transactions for this Item Charge.

- Close the Item Charge card to save your changes.

Using the CCH SureTax Features on Individual Service Documents

When you create a service document, the system applies the CCH SureTax settings that you selected on the Form of the item type, Customer, and CCH Setup form to the new document.

Using CCH SureTax Options with Dynamics NAV Features

The Dynamics NAV functions listed below either allow you to create a new document or line item based on an existing document or line item, or they allow you to quickly modify an existing document or line item. In some instances when you use these functions, the CCH SureTax options selected for the original document or line item may be retained on the new or modified item.

Setting CCH SureTax Options for Service Transaction Lines

By default, CCH SureTax setting for transaction lines are defaulted from the CCH Setup form. These settings on the CCH Setup form can be overridden at the form of the corresponding Item type and Customer form. The Transaction type code defaults from the form of the corresponding Item Type.

Note: In the case of the "Item" item type, if the transaction type code on the Item card is not configured, then the plugin will pull the Transaction Type Code from the Item Category. The Sales Type Code defaults from the corresponding Customer form.

The CCH SureTax plugin allows you to override CCH SureTax settings at the line level on Service transactions. Do the following to configure CCH SureTax settings for individual lines on a Service transaction.

- Select the transaction line for which to configure CCH SureTax settings.

- Select the Lines dropdown on the line items grid.

- Select Service Tax Calculation.

- Configure the desired CCH SureTax settings for the line.

Viewing Service Tax Details for Service Documents

The CCH SureTax Tax Display form allows you to view detailed information about the service tax for a document. To access this form, do the following:

- Open the service document for which you want to display tax details.

- Select Service Tax Results. The CCH Tax Results Document form opens. This form shows tax information sent to and returned from CCH SureTax at an order, line, and detail level. The information on this form cannot be edited.

- Do the following as needed to view tax details for a specific item:

- Details for specific line items are displayed in the Line Information grid. Scroll to the left or right as necessary to view line information details.

- To view tax details for a line item, select the line item. The tax grid will display the applicable tax information for the selected line item. Scroll to the left or right as necessary.

- Select Actions tab > View JSON in order to view the JSON of the CCH SureTax Request.

Calculating Tax Details for a Service

Service tax is calculated for a service any time you perform one of the following tasks:

- Open the Dynamics NAV Statistics window for a service document

- Print a service document

- Release a service document

- Post an order, invoice, return order, or credit memo

Note: If automatic tax calculation is disabled, tax will only be calculated when these events are performed.

Posting a Service Document

When you post a service order, return order, credit memo, or invoice, the plug-in finalizes the CCH SureTax transactions for the document.

Appendix: Modified Objects

| Plug-in Module | Type | ID | Name |

|---|---|---|---|

| AV | Page | 300 | Ship-to Address |

| AV | Page | 301 | Ship-to Address List |

| AV | Page | 368 | Order Address |

| AV | Page | 369 | Order Address List |

| AV | Page | 370 | Bank Account Card |

| AV | Page | 371 | Bank Account List |

| AV | Page | 5050 | Contact Card |

| AV | Page | 5052 | Contact List |

| AV | Page | 5703 | Location Card |

| AV | Page | 5714 | Responsibility Center Card |

| AV | Page | 5715 | Responsibility Center List |

| AV | Page | 5900 | Service Order |

| AV | Page | 5933 | Service Invoice |

| AV | Page | 5935 | Service Credit Memo |

| AV | Page | 5964 | Service Quote |

| AV | Page | 6630 | Sales Return Order |

| AV | Page | 6640 | Purchase Return Order |

| Base | Table | 15 | G/L Account |

| Base | Table | 18 | Customer |

| Base | Table | 23 | Vendor |

| Base | Table | 27 | Item |

| Base | Table | 152 | Resource Group |

| Base | Table | 156 | Resource |

| Base | Table | 5600 | Fixed Asset |

| Base | Table | 5722 | Item Category |

| Base | Table | 5723 | Product Group |

| Base | Table | 5800 | Item Charge |

| Base | Codeunit | 398 | Sales Tax Calculate |

| Base | Codeunit | 841 | Cash Flow Management |

| Base | Codeunit | 1290 | SOAP Web Service Request Mgt. |

| Base | Page | 17 | G/L Account Card |

| Base | Page | 21 | Customer Card |

| Base | Page | 22 | Customer List |

| Base | Page | 26 | Vendor Card |

| Base | Page | 30 | Item Card |

| Base | Page | 72 | Resource Groups |

| Base | Page | 76 | Resource Card |

| Base | Page | 300 | Ship-to Address |

| Base | Page | 301 | Ship-to Address List |

| Base | Page | 5600 | Fixed Asset Card |

| Base | Page | 5730 | Item Categories |

| Base | Page | 5733 | Item Category Card |

| Base | Page | 5800 | Item Charges |

| Purch | Table | 39 | Purchase Line |

| Purch | Codeunit | 90 | Purch. - Post |

| Purch | Codeunit | 415 | Release Purchase Document |

| Purch | Page | 49 | Purchase Quote |

| Purch | Page | 50 | Purchase Order |

| Purch | Page | 51 | Purchase Invoice |

| Purch | Page | 52 | Purchase Credit Memo |

| Purch | Page | 54 | Purchase Order Subform |

| Purch | Page | 55 | Purch. Invoice Subform |

| Purch | Page | 97 | Purchase Quote Subform |

| Purch | Page | 98 | Purch. Cr. Memo Subform |

| Purch | Page | 138 | Posted Purchase Invoice |

| Purch | Page | 139 | Posted Purch. Invoice Subform |

| Purch | Page | 140 | Posted Purchase Credit Memo |

| Purch | Page | 141 | Posted Purch. Cr. Memo Subform |

| Purch | Page | 509 | Blanket Purchase Order |

| Purch | Page | 510 | Blanket Purchase Order Subform |

| Purch | Page | 6640 | Purchase Return Order |

| Purch | Page | 6641 | Purchase Return Order Subform |

| Purch | Page | 9307 | Purchase Order List |

| Sales | Table | 36 | Sales Header |

| Sales | Table | 37 | Sales Line |

| Sales | Table | 111 | Sales Shipment Line |

| Sales | Table | 114 | Sales Cr. Memo Header |

| Sales | Codeunit | 414 | Release Sales Document |

| Sales | Page | 41 | Sales Quote |

| Sales | Page | 42 | Sales Order |

| Sales | Page | 43 | Sales Invoice |

| Sales | Page | 44 | Sales Credit Memo |

| Sales | Page | 46 | Sales Order Subform |

| Sales | Page | 47 | Sales Invoice Subform |

| Sales | Page | 95 | Sales Quote Subform |

| Sales | Page | 96 | Sales Cr. Memo Subform |

| Sales | Page | 132 | Posted Sales Invoice |

| Sales | Page | 133 | Posted Sales Invoice Subform |

| Sales | Page | 134 | Posted Sales Credit Memo |

| Sales | Page | 135 | Posted Sales Cr. Memo Subform |

| Sales | Page | 507 | Blanket Sales Order |

| Sales | Page | 508 | Blanket Sales Order Subform |

| Sales | Page | 6630 | Sales Return Order |

| Sales | Page | 6631 | Sales Return Order Subform |

| Sales | Page | 9305 | Sales Order List |

| Sales | Page | 10026 | Sales Order Shipment |

| Sales | Page | 10027 | Sales Order Shipment Subform |

| Sales | Page | 10028 | Sales Order Invoice |

| Sales | Page | 10029 | Sales Order Invoice Subform |

| Sales | Page | 36740 | Sales Tax Lines Subform Dyn |

| Service | Table | 5900 | Service Header |

| Service | Table | 5902 | Service Line |

| Service | Codeunit | 416 | Release Service Document |

| Service | Codeunit | 5980 | Service-Post |

| Service | Codeunit | 5988 | Serv-Documents Mgt. |

| Service | Page | 5900 | Service Order |

| Service | Page | 5907 | Service Item Worksheet Subform |

| Service | Page | 5933 | Service Invoice |

| Service | Page | 5935 | Service Credit Memo |

| Service | Page | 5936 | Service Credit Memo Subform |

| Service | Page | 5964 | Service Quote |

| Service | Page | 5966 | Service Quote Lines |

| Service | Page | 5972 | Posted Service Credit Memo |

| Service | Page | 5973 | Posted Serv. Cr. Memo Subform |

| Service | Page | 5978 | Posted Service Invoice |

| Service | Page | 5979 | Posted Service Invoice Subform |

| Service | Page | 6050 | Service Contract |

| Service | Page | 6053 | Service Contract Quote |

| Service | Page | 10052 | Service Order Stats |

| Service | Page | 10053 | Service Stats |