CCH® SureTax® for D365 Finance & Operations User Guide

Updated: June 18, 2024

Installation and Basic Configuration

Overview

CCH SureTax for Microsoft Dynamics 365 is a plug-in that integrates the CCH SureTax solution with Microsoft Dynamics 365. With CCH SureTax for Microsoft Dynamics 365 installed, you can accurately calculate sales tax for the United States and Canada and manage your sales tax compliance without the need to maintain sales tax rates inside Dynamics 365.

The CCH SureTax for Microsoft Dynamics 365 product includes four components that can be installed separately:

- Sales. Allows you to manage your sales tax compliance in the Accounts Receivable module of Dynamics 365.

- Purchasing. Allows you to manage your sales tax compliance in the Accounts Payable module of Dynamics 365.

- Project. Allows you to manage sales tax for both expense and sales transactions in the Projects module of Dynamics 365.

- Retail. Allows you to manage sales tax in a retail Point of Sale setting.

How It Works

When you compute the sales tax on a transaction in Microsoft Dynamics 365, the CCH SureTax for Microsoft Dynamics 365 plug-in sends the transaction information from Dynamics 365 to the web services. The calculated sales tax is returned to Dynamics 365. If needed, you can view the results of the CCH SureTax calculation before posting the transaction.

Figure 1: Information flow when using the CCH SureTax for Microsoft Dynamics 365 plug-in.

Features

With CCH SureTax for Microsoft Dynamics 365, you can do the following:

Supports the Microsoft Dynamics 365 web clients.

Manage sales tax for transactions created on any of the following Microsoft Dynamics 365 pages:

- Sales order

- Sales quotation

- Free text Invoice

- Purchase order

- Purchase requisition

- General Journal

- Vendor invoice

- Invoice Journal

- Project Quotation

- Invoice proposal

- Expense journal

Input separate addresses for each line item in a transaction.

Include Dynamics 365 discounts in line item amounts.

Include miscellaneous charges in sales tax calculations.

Assign stock keeping units (SKUs) to product groups, product items, sales categories, procurement categories, project categories, and miscellaneous charges in the CCH SureTax portal.

Display detailed results of the sales tax calculation on the Microsoft Dynamics 365 Temporary Sales Tax Transaction form.

Use price includes sales tax functionality on Sales Quotations and Sales Orders.

Note: This functionality applies to all the above forms except Invoice Proposal, Free Text Invoice, and Purchase Requisition.

Calculate both the standard Dynamics 365 sales tax and the plug-in sales tax on the same order.

Installing SureTax

There are four steps to installing and setting up CCH SureTax for Dynamics 365 for Finance & Operations:

- Import the Model Files

- Create a Deployment Package

- Deploy and Apply the Package

- Perform Setup

Importing the Model Files

Get the AxModelSource ZIP file from CCH SureTax.

On the VM/machine, navigate and open the folder where the latest AxModelSource zip package exists.

Unzip the model files on your machine.

Open Command Prompt in Administrator mode and execute the following commands (in order seen below for each module)

- Note: If you install a model on a development environment that contains customization to that model (in a higher layer), you may need to resolve code or metadata conflicts using Visual Studio.

For Account Receivables:

cd "[path of the metadata store where model should be imported]\Bin" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_Base-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_BaseSales-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_Sales-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\ApplicationSuite\_CCH\_SureTax- CCH Inc..axmodel"Note: The "ApplicationSuite" command should be executed only on versions prior to 7.3.

For Account Payables

cd "[path of the metadata store where model should be imported]\Bin" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_Base-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\ CCH\_SureTax\_BasePurch-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_Purch-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\ApplicationSuite\_CCH\_SureTax- CCH Inc..axmodel"Note: The "ApplicationSuite" command should be executed only on versions prior to 7.3.

For Account Projects

cd "[path of the metadata store where model should be imported]\Bin" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_Base-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\ CCH\_SureTax\_BaseSales -CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\ CCH\_SureTax\_Proj-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\ApplicationSuite\_CCH\_SureTax- CCH Inc..axmodel"Note: The "ApplicationSuite" command should be executed only on versions prior to 7.3.

For Retail:

cd "[path of the metadata store where model should be imported]\Bin" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_Base-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_BaseSales-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_Sales-CCH Inc..axmodel" ModelUtil.exe -import -metadatastorepath="[path of the metadata store where model should be imported]" -file="[path where model files are unzipped]\CCH\_SureTax\_Retail-CCH Inc..axmodel"

Building Models

Open Visual Studio.

Log in with the MSDN credentials

Click Dynamics AX > Model Management > Refresh models.

If you are using a version prior to 7.3, click Dynamics AX > Build Models.

- Click the Application Suite only on the packages tab.

- Click the Options tab and set the parameters

Click Build.

Deselect the application suite, select CCH_SureTax_Base, and then click Build.

If you are installing Sales, Projects, and/or Retail, deselect CCH SureTax_Base, select 8*CCH_SureTax_BaseSales**, and then click Build.

If you are installing Sales, deselect your previous selection, select CCH_SureTax_Sales, and then click Build.

If you are installing Projects, deselect your previous selection, select CCH_SureTax_Proj, and then click Build.

If you are installing Purchasing, deselect your previous selection, select CCH_SureTax_ BasePurch, and then click Build.

If you are installing Purchasing, deselect your previous selection, select CCH_SureTax_ Purch, and then click Build.

If you are installing Retail, deselect your previous selection, select CCH_SureTax_Retail, and then click Build.

Note: If you see any errors post build, refresh the models and build the only CCH ones on the packages tab and check the reference model check box in at the bottom of the package tab.

Installing the Retail Package

In the Retail Package folder of the provided ZIP file, there is a package file named RetailDeployablePackage. If the environment is hosted in Azure, use the following instructions to deploy it: https://docs.microsoft.com/en-us/dynamics365/unified-operations/dev- itpro/deployment/apply-deployable-package-system.

To apply this to a local or development instance, follow use the following instructions: https://docs.microsoft.com/en-us/dynamics365/unified-operations/dev- itpro/deployment/install-deployable-package.

Importing Licenses

For information on importing licenses, please see https://docs.microsoft.com/en- us/dynamics365/unified-operations/dev-itpro/dev-tools/isv-licensing

- Go to "Create a package and generate a customer-specific license" -- Import the license into the target environment.

- Copy command line from the console (command line is also available below).

- Import the licenses and model files in your Tier 1 environment (Dev or Demo).

- C:\AOSService\PackagesLocalDirectory\Bin\Microsoft.Dynamics.A X.Deployment.Setup.exe --setupmode importlicensefile -- metadatadir c:\packages --bindir c:\packages --sqlserver . -- sqldatabase axdb --sqluser axdbadmin --sqlpwd ******** -- licensefilename c:\templicense.txt

- Create deployable package with CCH SureTax license and models and deploy those in your Tier

- (UAT & above) environments.

Synchronizing the Database

Once the model files are built and the licenses are imported, synchronize the database from Visual Studio.

- Open Visual Studio.

- Select Dynamics AX > Synchronize Database. This can take more than an hour to complete.

- Once the build is complete, restart IIS and SQL server.

Enabling Reporting

Note: For instructions on how to deploy SSRS reports, see https://community.dynamics.com/ax/b/365operationswithsukrut/archive/2017/12/21/depl oy-reports-in-dynamics-365-for-operations

- Open Source control and map the metadata and project folder to their appropriate path.

- Once mapped, open the upgradesolution solution.

- Select the following folders to deploy the report for the invoice forms:

- For Sales Invoice:

- Expand the CCH SureTax Base sales > Reports folder.

- Right-click the Sale Invoice report xml and select Deploy reports.

- For FTI invoice:

- Expand the CCH SureTax sales > Reports folder.

- Right-click the FTI Invoice report XML and select Deploy reports.

- For Vendor Invoice:

- Expand the CCH SureTax Base Purch > Reports folder.

- Right-click the Vendor Invoice report XML and select Deploy reports.

- For Invoice Proposal:

- Expand the CCH SureTax Proj > Reports folder.

- Right-click the Invoice Proposal report XML and select Deploy reports.

- For Reconciliation Report:

- Expand the CCH SureTax Retail > Reports folder.

- Right-click on the Retail Reconciliation Report XML and select Deploy Reports.

- For Sales Invoice:

Creating the Deployment Package Using Visual Studio

- In Visual Studio, select Dynamics AX > Deploy > Create Deployment Package.

- Select the following packages:

- If you are using a version earlier than 7.3 Update 12, select the Application Suite package

For Accounts Receivable, select the following:

- CCH\_SureTax\_Base - CCH\_SureTax\_BaseSales - CCH\_SureTax\_SalesFor Accounts Payable, select the following:

- CCH\_SureTax\_Base - CCH\_SureTax\_BasePurch - CCH\_SureTax\_PurchFor Projects, select the following:

- CCH\_SureTax\_Base - CCH\_SureTax\_BaseSales - CCH\_SureTax\_ProjFor Retail, select the following:

- CCH\_SureTax\_Base - CCH\_SureTax\_BaseSales - CCH\_SureTax\_Sales - CCH\_SureTax\_Retail

- If you are using a version earlier than 7.3 Update 12, select the Application Suite package

- Provide the package file location in the dialog box.

- Click Create to generate the package. Get the license file from CCH based on the serial number of AX installed in your production environment. Unzip the package. Add the license files to an unzipped package in the following folder: AOSService\Scripts\License.

- Zipthe package again now with the license files.

Deploying and Applying the Package to Lifecycle Services

- Log in to lcs.dynamics.com.

- Select the Shared Asset library and do the following:

- Select the Software deployable package asset type.

- Click the plus sign (+) to upload the package.

- Enter the name and description of the package you are uploading.

- Select the uploaded package.

- Click Publish.

- Click the project in Lifecycle Services where the package needs to be installed.

- Click Asset Library. You may need to scroll to the right for this option to be visible.

- In the Asset library, click Import to import the package.

- Return to the project's home screen and select the virtual machine environment.

- Verify the virtual machine is running.

- Click Maintain, and then click Apply updates. A window displays, showing the eleven steps of deployment.

Basic Setup

The following sections contain information about the basic setup that you must perform before you can use CCH SureTax for Microsoft Dynamics 365 to calculate sales tax.

Suggested Workflow for Setup

- Review the next section, Before You Set Up CCH SureTax for Microsoft Dynamics 365. This section contains information that will be useful during setup.

- Configure the system-level settings. In this step, you identify the location where SureTax Web Services is installed and then import the system data, among other tasks. See [Configuring System Level Settings] for details.

- Configure the tax codes and tax groups. See Configuring or Modifying Tax Codes and Tax Groups for details.

Before You Set Up SureTax

We recommend that you review the information in this section before attempting to set up the CCH SureTax for Microsoft Dynamics 365 plug-in.

About the CCH SureTax Global Workspace

The CCH SureTax Global workspace is centralized around the SureTax administration process. Here the user can easily configure SureTax settings and defaults on Standard Dynamics 365 for Operations' forms.

Initially, the Global Workspace is accessible in two ways:

- On your Dynamics 365 home page among the standard Dynamics 365 workspaces.

- On the left Navigation pane, select Modules > Tax > CCH tab > Workspaces tab > CCH SureTax Global Workspace.

The Global Workspace has three sections: Summary, Configure CCH SureTax on Form, and Links.

Global Workspace — Summary

The summary section has tiles for each standard AX form where SureTax fields have been added to be configured as default values for Dynamics 365 transaction forms.

- Customers

- Released products

- Sales Categories

- Vendors

- Procurement Categories

- Projects

- Bank accounts

- Purchase Charges codes

- Main accounts

- Fixed assets

- Books

- Project Categories

- Mode of delivery

- Terms of delivery

- Sales Charges code

- Tax exemption number

- Units

On each tile, a number indicates the number entries of that form that have yet to be fully configured. When a tile is selected, you are taken to the form of the first entry. A full list of the entries that are yet to be configured is displayed on the left. As you navigate through the list on the left, the form of the selected entry will update on the right, where the CCH SureTax fields can be configured.

Global Workspace — Configure CCH SureTax on Form

This section is similar to the Summary section. In this section, there is a column of tabs for each standard AX form where SureTax fields have been added to be configured as default values for Dynamics 365 transaction forms.

- Customers

- Released products

- Sales Categories

- Vendors

- Procurement Categories

- Projects

- Bank accounts

- Purchase Charges codes

- Main accounts

- Fixed assets

- Books

- Project Categories

- Mode of delivery

- Terms of delivery

- Sales Charges code

- Tax exemption number

- Units

When a tab is selected, a list to the right shows all entries for the selected tab that have yet to be configured. You can navigate through the tabs on the left, then navigate through the entries for that tab on the right, and then select the entry you want to configure. When you select an entry, you are taken to the form of that entry. You can then configure the SureTax settings.

Global Workspace — Links

The third section displays a column with the following links:

- CCH SureTax Basic Setup

- CCH SureTax Journal Setup

- CCH SureTax Sales Setup

- CCH SureTax Data Exchange Setup

- CCH SureTax Purchase Setup

- CCH SureTax Retail Store Setup

General Ledger Parameters

CCH SureTax for Microsoft Dynamics 365 calculates tax at the line-item level. For the plug-in to update tax amounts in Dynamics 365 correctly navigate to General ledger > Setup General ledger parameters > select the Sales tax tab.

Check that the following settings are configured:

- Calculation method is set to “Line”.

- Amount includes sales tax is set to “No”.

- Invoice – Sales tax amount per invoice line in the Tax options area is set to “Yes”.

- Check sales tax code is set to “None”.

Dates Recorded in SureTax

Before using CCH SureTax for Dynamics 365, it is important to understand the difference between the CCH SureTax Transaction Date and the CCH SureTax Content Date fields.

CCH SureTax Transaction Date is stored in CCH SureTax for each transaction and specifies the period in which the transaction should be selected for liability reports. CCH SureTax for Dynamics 365 always sends the current date to CCH SureTax as the Transaction Date. This ensures that reports from Dynamics 365 contain the same transactions as reports from CCH SureTax.

CCH SureTax Content Date is stored in CCH SureTax for each transaction. CCH SureTax uses this date to determine the effective tax rate used in the tax calculation. The value that is sent to CCH SureTax as the Content Date is determined by the Calculation Date Type parameter.

For Journals, the value that is sent to CCH SureTax as the Content Date will always be the current date.

For Accounts Receivable and Accounts Payable, this setting is on the General Ledger Parameters form under the Sales Tax tab. The following options are available:

- Document Date. If document date is selected, the date the document was created will be sent as the CCH SureTax Invoice Date.

- Delivery Date. If delivery date is selected, the date an order is delivered will be sent as the CCH SureTax Invoice Date.

- Invoice Date. If invoice date is selected, the date a Dynamics 365 invoice is generated will be sent as the CCH SureTax Invoice Date.

Business Rules for the SureTax Plug-in

For the plug-in to function correctly, CCH SureTax must be configured as follows: The following general setup items must be configured:

- CCH SureTax URL

- CCH SureTax client number

- CCH SureTax validation key

The following System Import Data items must be completed:

- CCH SureTax data URL

- CCH SureTax data client number

- CCH SureTax data validation key

About SureTax Security Roles

Custom security roles are included with the plug-in for managing user access to plug-in functionality. For each component of the plug-in a normal user and a power user role is available. Assign CCH SureTax Power User roles to users who should have access to edit plug-in settings. Assign the CCH SureTax User roles to those users who should have read only access to plug-in settings.

Note: For more information on security roles, see Microsoft Dynamics 365 documentation.

About Tax Exempt Numbers and Tax Exemption Codes

When you set up CCH SureTax for Microsoft Dynamics 365, a tax exemption code should be sent to CCH SureTax when calculating sales tax. Exemption codes provide information to CCH SureTax about the sales taxes that are applicable for the transaction.

- Tax exemption codes originate in CCH SureTax and provide a way to indicate which sales taxes should be applied to a transaction. SureTax includes a standard set of exemption classes (see SureTax Exemption Codes).

- Tax exempt numbers are created in Microsoft Dynamics 365. For CCH SureTax to use the tax exempt number to compute sales tax, the tax exempt number must either correspond with one of the standard CCH SureTax exemption codes, or a custom exemption must be created in CCH SureTax for that tax exempt number.

Assigning an Exemption Code to a Dynamics 365 Tax Exempt Number

You can associate an exemption code to a Microsoft Dynamics 365 tax exempt number. If you do so, then the exemption code assigned to the tax exempt number is defaulted onto transaction forms for customers or vendors that have the exemption number. See Basic Setup for more information.

About SureTax Invoice Reporting

The CCH SureTax Invoice Reporting option will be availale during Basic setup only when the industry is Communications or Utilities. When CCH SureTax Invoice Reporting is "Yes," the CCH Invoice Report format will display for printed invoices with tax code names printed in the invoice. Zero tax amount lines will not display. CCH SureTax Invoice Reports will not show customizations.

When the SureTax Invoice report button is "No," the CCH SureTax Invoice Report will not display. The normal AX report will display for printed invoices.

For General industry, the normal AX report will display for printed invoices.

Configuring System Level Settings

Select the CCH menu under the Tax module menu.

In the Forms section of the navigation pane, select CCH SureTax > Basic > SureTax Basic Setup > General.

Select options for each of the fields in the General section. The items that are available in each field depend on which packages of CCH SureTax data your company has purchased. The fields in this section are as follows:

- CCH SureTax URL

- CCH SureTax client number

- CCH SureTax validation key

Select options for each of the fields in the Import System Data section:

- CCH SureTax data URL

- CCH SureTax data client number

- CCH SureTax data validation key

Note: If you do not know the location for the Web service, your CCH Training and Consulting representative can assist you in identifying this location. If there is a problem accessing the CCH SureTax Web Services server, you must resolve the issue before you can continue with this procedure.

Select the Industry for your company. The default is always General.

Select whether to use the CCH SureTax Invoice Report.

Note: CCH SureTax Invoice Report applies only for Telecommunications and Utilities industries.

Enable Logging. Select whether to use the CCH SureTax Logging Feature.

Note: When enable is set to Yes SureTax call logs are available in the transactions.

Cancellation for Duplicated Final Invoices option is added to avoid duplicate posting in SureTax.

Note: When Cancellation of Duplicate Final Invoices option is set to “Yes” a cancel request is send before each posting.

Click Import system data and configure the Import System Data task. CCH SureTax for Microsoft Dynamics 365 connects with SureTax Web Services and imports the data required to complete the setup. The Import System Data Task opens.

- Configure the batch processing setting.

- Enter a task description.

- Configure the batch group and privacy settings.

- Click Alerts and configure alerts for the batch job.

- Click Recurrence and configure the recurrence pattern.

Configuring or Modifying Tax Codes and Tax Groups

Before using CCH SureTax with Dynamics 365 for Finance & Operations, you must configure sales tax codes and groups. Part of the setup process is selecting how sales tax should be credited to general ledger accounts. You can select from either of the following two options:

- Breakdown by state and country. When this option is selected, a separate tax group is created for each U.S. state, for each Canadian province, and for other supported countries, and sales tax will be credited to a general ledger account based on the state or province where the sales tax is applied.

- Single sales tax group. A single sales tax groups will be created. STALL will contain the required tax codes for U.S. and Canada.

The other setup that is necessary for the tax codes depends on which of these options you select. Detailed instructions for both options are included below.

Configuring Tax Codes and Groups by State

Use the following procedure to set up tax codes and tax groups if you want to credit sales tax to different general ledger accounts based on the state where tax is applied.

Select the CCH menu under the Tax module menu.

In the Forms pane, expand Basic, and then open the SureTax Basic Setup form.

Select the Tax Code Setup tab.

In the Tax Setup Option section, select Breakdown by state and country.

If needed, select default options to be used for all the states or provinces in the Default from section. You can select from the following defaults:

- Ledger posting group. The options available here are set up in General Ledger > Setup > Sales Tax > Ledger posting groups.

- Settlement period. The options available here are set up in General Ledger > Setup > Sales Tax > Sales tax settlement periods.

- Currency. The options available here are set up in General Ledger > Setup > Exchange rates.

Note: You can override the defaults by selecting different options for individual states or provinces in the Tax code settings grid.

To apply a default you selected in the previous step, click Assign default value, and then select the default option to apply. Repeat this step for each default that you want to apply.

In the Tax code settings grid, select the box for each state, province, or country for which you are setting up tax codes.

Note: You can click Select All to select all states, provinces, and countries, or you can click Deselect All to clear the selection for all.

If you are not using default options, or if you need to override default options for some states, provinces, or countries, select options for each of the following fields in the Tax code settings grid:

- Ledger posting group. The options available here are set up in General Ledger > Setup > Sales Tax > Ledger posting groups.

- Settlement period. The options available here are set up in General Ledger > Setup > Sales Tax > Sales tax settlement periods.

- Currency code. The options available here are set up in General Ledger > Setup

- Exchange rates.

Click Update to apply the tax code settings that you have selected.

Note: We recommend that you run the update as a batch job so that it can execute on a scheduled basis. That way when the appropriate tax names change for any of the selected tax authorities, the scheduled update will create new tax groups and tax codes referencing the new name. It is also important the import system data job is executed with the same frequency so that the new tax names can be downloaded from CCH SureTax.

Configuring Tax Codes and Groups for a Single Sales Tax Group

Use the following procedure to set up tax codes and tax groups if you want to credit all sales tax to a single account.

- Select the CCH menu under the Tax module menu.

- In the Forms pane, go to SureTax > Basic, and then select SureTax Tax Setup. The SureTax Tax Setup form displays.

- Select Single sales tax group in the Tax setup option section.

- In the Tax code settings section, select an option for each of the following:

- Ledger posting group. The options available here are set up in General Ledger > Setup > Sales Tax > Ledger posting groups.

- Settlement period. The options available here are set up in General Ledger > Setup > Sales Tax > Sales tax settlement periods.

- Currency code. The options available here are set up in General Ledger > Setup

- Exchange rates.

- Click Update to apply the tax code settings.

Configuring Custom Tax Codes

As taxes are calculated, CCH SureTax returns tax types. By default, tax types are mapped back to the following default tax codes for each tax group.

Default Tax Codes for General Industry

- Canada

- Goods and Services tax (GST)

- Provincial Sales Tax (PST)

- Harmonized Sales Tax (HST)

- Default (GPH)

- United States

- Sales Tax (S)

- Use Tax (U)

- Default (SU)

- VAT Countries

- Value Added Tax (VAT)

- Default (SU)

When Single Sales tax group is selected in Tax Setup:

- Single Sales tax group

- Default (SU)

- Provincial Sales Tax (PST)

- Sales Tax (S)

- Use Tax (U)

- Goods and Services Tax (GST)

- Value Added Tax (VAT)

Default Tax Codes for Communications and/or Utilities Industry

- Canada

- Goods and Services tax (GST)

- Federal Regulatory Assessment Fees (FRAF)

- Federal Universal Service Fund (FUSF)

- State and Local Regulatory Fees and Surcharges (SLRS)

- Telecommunications and Excise Tax (TEX)

- United States

- Federal Regulatory Assessment Fees (FRAF)

- Federal Universal Service Fund (FUSF)

- Sales Tax (S)

- Use Tax (U)

- State and Local Regulatory Fees and Surcharges (SLRS)

- Telecommunications and Excise Tax (TEX)

- VAT Countries

- Value Added Tax (VAT)

- Default (SU)

When Single Sales tax group is selected in Tax Setup:

- Single Sales tax group

- Sales Tax (S)

- Use Tax (U)

- Federal Regulatory Assessment Fees (FRAF)

- Federal Universal Service Fund (FUSF)

- State and Local Regulatory Fes and Surcharges (SLRS)

- Telecommunications and Excise Tax (TEX)

- Goods and Services Tax (GST)

- Value Added Tax (VAT)

As transactions are invoiced, each applicable tax code is listed as a separate line on the temporary sales tax transaction window, posted invoice journal, printed invoice. Use the following procedure to create new tax codes and change the tax type associations in order to have the desired tax codes for reporting.

Select the CCH menu under the Tax module menu.

In the Forms pane, go to SureTax > Basic, and then select SureTax Basic Setup. The SureTax Setup form displays.

Select the Tax Code setup tab.

Select Single sales tax group or Breakdown by state and country in the Tax setup option section.

Select Custom tax code options.

If the Breakdown by state and country option is selected in Tax Setup, choose the following. This step does not apply if Single Sales Tax Group is selected in Tax Setup.

- Country

- State

Note: For VAT countries, the State field will be blank.

To create a new custom tax code, click New or press ALT + N.

Configure the following fields in the Custom Tax code settings grid:

- Sales tax code

- Name

- Tax types

If you need to override default options for some tax codes, select options for each of the following fields in the Custom Tax code settings grid:

- Ledger posting group. The options available here are set up in General Ledger > Setup > Sales Tax > Ledger posting groups.

- Settlement period. The options available here are set up in General Ledger > Setup > Sales Tax > Sales tax settlement periods.

- Currency code. The options available here are set up in General Ledger > Setup

- Exchange rates.

Close the form to save the settings.

Re-adding Tax Codes

In the Custom Tax code grid, Sales tax codes disappear from the grid when all the tax types associated with the tax code are unassociated.

To re-add the default tax codes, do the following:

- Navigate to the Default forms section under the Tax code setup tab on the SureTax basic setup form.

- Click Update.

- Navigate to the Custom tax code options section under the Tax code setup tab on the SureTax basic setup form.

- Re-add the tax code.

To re-add the custom tax codes, do the following:

- Navigate to the Item sales tax groups form.

- Under the Setup tab, remove the sales tax code.

- Navigate to the Sales tax groups form.

- Select Sales tax group and do one of the following:

- If removing from state and country sales tax group, select the sales tax group for the state and country.

- If removing from single sales tax group, select STAll.

- Under the Setup tab, remove the intended sales tax code.

- Navigate to the Sales tax codes form.

- Remove the intended sales tax code.

- Navigate to the Custom tax code options section under the Tax code setup tab on the SureTax basic setup form.

- Re-add the tax code.

General Merchandise

- Select the CCH menu under the Tax module menu.

- In the Forms pane, go to SureTax > Basic, and then select SureTax Basic Setup. The SureTax Setup form displays.

- Select the General Merchandise tab.

- Select whether to use the General Merchandise

- When Enable General Merchandise is set to “Yes”, the settings will be copied to the adjustment lines when lines have different SureTax settings and posting will be allowed even if the lines item settings are different.The default is always "No"

- Select options for the following fields in the General Merchandise Defaults section:

- Tax Exemption Code. Select a default Tax Exemption Code. This value defaults into the order-header settings but can be overridden on the Dynamics 365 Customers form.

- Tax Exemption Reason Code. Select a default tax exemption reason code. This value defaults into the order-header settings but can be overridden on the Dynamics 365 Customers form.

- Regulatory Code. Select a default regulatory code from the list. The option you select here will default for order-header settings, but can be overridden on the Dynamics 365 Customers form. The options listed here vary depending on which data packages have been purchased with the main CCH SureTax application.

- Sales Type code. Select a default sales type from the list. The option you select here will default for order-header settings, but can be overridden on the Dynamics 365 Customers form.

- Transaction Type Code. Select a default transaction type from the list. The option you select here will default for order-header settings, but can be overridden on the Dynamics 365 Released Products, Category Hierarchy, Main Account, Books, Fixed Asset, or Charges form.

- Tax Situs Rule. Select the default Tax Situs Rule.

- Unit Type Code. (Displays only if the industry is Communications or Utilities.) Select the default Unit type code.

Mapping Tax Exemption Number to Tax Exemption Code

If needed, you can assign tax exemption codes to individual tax exempt numbers by doing the following:

- Select the General Ledger menu in the Dynamics 365 for Operations Navigation pane.

- In the Forms pane, go to Setup > Sales Tax > External, and then select Tax exempt numbers. The Tax exempt numbers form displays.

- Select the tax exempt number for which you are assigning a tax exemption code.

- Select the General tab.

- In the Tax exemption code section column, select a tax exemption code from the list. Notes: Items listed in the tax exemption code field are set up in the main CCH SureTax application.

- Close the form to save the tax exemption code assignments.

Configuring SureTax exemptions from Customer page

To modify exemptions in SureTax from Dynamics 365 Finance and Operations do the following:

- Navigate to the customer that you want to modify exemptions for.

- Click on the Customer Exemptions button. It is located under the Customer tab and in the CCH SureTax group.

On the form that is opened, the existing customer exemptions from the SureTax application will display in the ERP for the selected customer. When a row is edited or deleted the same operation is applied to the exemption in SureTax. When a new row is added, the new customer exemption will be added to SureTax.

SureTax Data Exchange Setup

The values that are selected in the form are send to SureTax for various data exchange parameters

To set up the data exchange form, do the following:

- Go to Workspace > Tax > CCH SureTax > Basic > CCH SureTax Data Exchange Parameter.

- Select the dropdown values for Parameter, Table, Fields and Static text for the form line type of the transaction form you want to send to SureTax (e.g. LocationCode). The selected values will be sent to SureTax in the correct parameter.

SureTax Journal Setup

The options you select when you configure the journal component will be the defaults for all journal transactions. The default settings can be overridden at the account level.

To set up the journal component, do the following:

- Go to Workspace > Tax > CCH SureTax > Basic > CCH SureTax Journal Setup.

- On the General tab, select options for each of the following: -

- Tax option. Select the default Tax option.

- Tax exemption code. Select the default Tax exemption code.

- Tax Exemption Reason Code. Select a default tax exemption reason code. This value defaults into the order-header settings but can be overridden on the Dynamics 365 Customers form.

- Regulatory Code. Select the default Regulatory code.

- Sales Type code. Select the default Sales type code.

- Transaction type code. Select the default transaction type code.

- Tax Situs Rule. Select the default tax situs rule.

- Unit Type Code. (Displays only if the industry is Communications or Utilities.) Select the default Unit type code.

- Select Enable Plug-in for Journal. The default is always Disabled.

- No SureTax plugin code will execute when plugin is disabled for a module.

- Journal account selection. The option selected here indicates whether the CCH SureTax options for journal transactions should use the defaults selected from the account or for the offset account.

- On the Default enable tab, select options for each of the following:

- General journal enable

- Invoice journal enable

- Expense journal enable

- Invoice approval enable

- On the Journal forms line settings tab, select the Ship to options, SKU Table, SKU Field, and Transaction type option for the lines on each purchase form:

- General Journal

- General Journal line

- Invoice Journal

- Invoice Journal line

- Expense Journal

- Expense Journal line

- Invoice Approval/Invoice Register

- Invoice approval line

- On the Ship From Address tab, enter the default ship from address to be sent to CCH SureTax for Journal transactions. This address will be used when no ship from address is available.

- On the Ship to Address tab, enter the default ship to address to be sent to CCH SureTax for Journal transactions. This address will be used when no ship to address is available.

- Close the CCH SureTax Journal Setup form to save the settings.

SureTax Init Open Transactions

This feature provides the ability to update open orders (transactions) with SureTax line settings when going live with existing open orders.

To update the transactions with suretax settings:

- Go to Modules > Tax > Basic > CCH SureTax Init Open Transactions.

- Select the form(s) to update from the Transaction Type dropdown.

- Set the date range and click OK.

Users have the option to update multiple forms or a single form. This feature is available across all modules. However, if the Sales model is installed, only sales forms will be displayed in the dropdown list.

Note: Power users can update orders with SureTax settings, while basic users do not have access to this feature.

What will be Initialized?

- Transactions with Open or in Back Order Status with no prior CCH SureTax Settings.

- Transactions within the created dates selected.

Note: If the CCH SureTax Settings are opened and saved for the transaction to be updated (initialized), the transactions will not be updated when you run the Init process to update the settings. SureTaxSetup table is checked to see if the order is initialized.

What will not be initialized?

- Transactions with previous CCH SureTax Settings or previously initialized.

- Transactions with other statuses other than Open or Back Order.

- Transactions with delivered status was intentionally omitted to avoid re-calculating taxes that have already been calculated.

- Transactions with created date not selected.

- If the header is already initialized, the lines will NOT get initialized.

Transaction types that get initialized with CCH SureTax Settings:

This is a list of the transaction types that will be initiated if they meet the criteria listed.

- Sales Order

- Status - Open

- Based on Created Date

- Sales Quotation

- Status - Open

- Based on Created Date

- Free Text Invoice

- Status - In Process

- Based on Created Date

- Purchase Order

- Status - Open

- Based on Created Date

- Purchase Requisition

- Status - requisition status is draft (only drafts are updated)

- Based on Created Date

- Project Quotation

- Status - Open

- Based on Created Date

- Vendor Invoice

- Status - In process (line status must be draft)

- Based on Created Date

- Invoice Journals/ Ledgers

- Status – Not Posted

- Based on Acknowledgement Date

- Expense journals

- Status – Open

- Based on Acknowledgement Date

- Project invoice proposal

- Status - Open

- Based on Invoice Date

- Sales Order

SureTax Delete Address Mapping

This feature provides the ability to delete/purge the records from the SureTaxAddrMappings Table to help boost the performance.

To delete/purge the records from the SureTaxAddrMappings:

- Go to Modules > Tax > Basic > CCH SureTax Delete Address Mapping - select

- Option for Batch or manual - click OK.

once the batch job completes, all those invalid transactions will be deleted

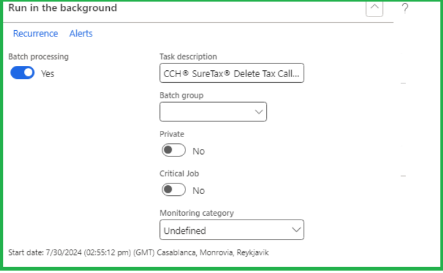

SureTax Delete Tax Call Logs

If your SureTaxCallLog database is growing too large, and you would like to reduce the size below are instructions to do so:

Go To Modules > Tax > Basic > CCH® SureTax® Delete Tax Call Log.

Select the number of days to keep.

- Leave it as 0 if you do not want to keep any days.

- Enter 30 days or more, if you want to keep the last 30 days or more.

- Click OK.

If you would like to run it as a batch process:

- Enable Batch Processing (by changing it to Yes).

- Select any of the other options if applicable.

- Click OK.

Setting SureTax Options on a General Journal

By default, CCH SureTax settings on a General Journal default from the SureTax Journal setup form. These defaults are overridden by settings from the selected account form (Ledger, Customer, Vendor, Project, Fixed Asset, Bank) for the transaction type code. If the Journal account selection on the Journal setup form is Account, overriding CCH SureTax settings will come from the selected account form. If the Journal account selection on the Journal setup form is Offset Account, the overriding CCH SureTax settings will come from the selected offset account form. If CCH SureTax settings are not configured on the account form, the selections will come from the CCH SureTax Journal setup form.

To select CCH SureTax options at the Invoice journal, do the following:

- Create a new General journal, or select an existing General journal for which you want to set CCH SureTax options.

- In the General journal action pane, select SureTax Setup. The SureTax Setup form for General journal displays.

- Select the following CCH SureTax

- Enable. Select this option if you want CCH SureTax to calculate sales tax for this General journal.

- Tax purpose. Select whether the transaction is to calculate sales tax or make a sales tax adjustment.

- Tax option. Select whether to calculate sales tax or calculate use tax.

- Sales type code

- Regulatory code

- Tax exemption code

- Tax exemption reason code

- Transaction type code

- Tax Situs Rule. Select the Tax situs rule for the General journal.

- Primary zip code. Enter the Primary ZIP Code for the General journal.

- Secondary zip code. Enter the Secondary ZIP Code for the General journal.

- Unit Type Code. (Displays only if the industry is Communications or Utilities.) Select the Unit type code for the General journal.

Calculating and Viewing Sales Tax for General Journal

After you select to calculate the tax, tax information is displayed on the Temporary sales tax transaction form.

- Open a General Journal.

- Click the Sales Tax button. The Temporary sales tax transaction form displays.

- To view detailed tax calculation information, click the SureTax Tax Details button. The CCH SureTax Tax Display form opens. This form shows tax information sent to and returned from CCH SureTax.

- Do the following as needed to view tax details for a specific item:

Details for specific line items are displayed in the Line Information grid. Scroll to the left or right as necessary to view line information details.

To view tax details for a line item, select the line item. The tax grid will display the applicable tax information for the selected line item. Scroll to the left or right as necessary.

Note: The information on this form cannot be edited.

Finalizing a General Journal

Tax Calculation

When you generate an invoice from a General Journal for tax calculation, CCH SureTax calculates the tax and records the final amounts for compliance purposes. Taxes can be viewed on vouchers and printed documents through normal Dynamics 365 functionality.

If the CCH SureTax Invoice Reporting enabled in the Basic Setup, the taxes will display on the CCH SureTax Invoice Report.

Tax Only Adjustment

When you generate an invoice from a General Journal for a tax only adjustment, CCH SureTax makes a tax only adjustment to the liability amounts in CCH SureTax.

Configuring and Using The Sales Component

Overview

The Sales component of the CCH SureTax for Dynamics 365 for Finance & Operations plug-in integrates with the Dynamics 365 Accounts Receivable module. It provides tools for managing sales tax compliance on the sales side of your business.

The first half of this chapter explains how to configure the options that impact the Sales component. The setup process includes selecting options in the CCH SureTax plug-in, as well as setting defaults on some standard Dynamics 365 forms.

The second half of the chapter, titled Using the Sales Component, includes information about using CCH SureTax options when entering transactions into Dynamics 365 for Finance & Operations. This section also describes how to view sales taxes prior to posting and how to post the sales tax transactions.

Configuring the SureTax Sales Component

Before using the Sales component of the CCH SureTax for Dynamics 365 for Finance & Operations plug-in, you must do the following:

- Configure the options in the Sales component. See [Basic Setup of the Sales Component] for more information.

- Set default values for CCH SureTax fields that have been added to the following standard Microsoft Dynamics 365

- Customer form. On this form, you can set the sales tax options for specific customers as needed. See [Setting CCH SureTax Options for a Customer on the Dynamics 365 Customer Form] for more information.

- Released products. On this form, you can set the sales tax options for specific products as needed. See [Setting Sales Tax Options for a Product on the Dynamics 365 Released Products Form] for more information.

- Sales Category Hierarchy. On this form, you can set the sales tax options for specific categories as needed. See page [Setting Sales Tax Options for Sales Category on the Dynamics 365 Category Hierarchy Form] for more information.

- Main account. On this form, you can set the sales tax options for specific general ledger account as needed. See [Setting Sales Tax Options for a Main Account on the Dynamics 365 Main Accounts Form]* for more information.

- Fixed assets. On this form, you can set the sales tax options for specific fixed assets accounts as needed. See [Setting Sales Tax Options for a Fixed Asset on the Dynamics 365 Fixed Assets Form] for more information.

- Books. On this form, you can set the sales tax options for specific book accounts as needed. See [Setting Sales Tax Options for a Book on the Dynamics 365 Book Form] for more information.

- Charges Code. On this form, you can set the sales tax options for specific charges as needed. See [Setting Sales Tax Options for a Miscellaneous Charge Code on the Dynamics 365 Charges Code Form] for more information.

- Mode of delivery. You can select sales tax options for each mode of delivery that is available in Microsoft Dynamics 365. See [Setting Options on the Dynamics 365 Mode of Delivery Form] for more information.

- Project category. You can select sales tax options for each project category that is available in Microsoft Dynamics 365. See [Setting CCH SureTax Options for a Project Category] for more information.

- Terms of delivery. Use this form to designate the freight on board option for each delivery term. See [Setting Options on the Dynamics 365 Delivery Terms Forms] for more information.

Basic Setup of the Sales Component

The options you select when you perform the following procedure will be the defaults for all sales, unless overridden at the order header or line item level.

To set up the sales component, do the following:

- Go to Workspace > Tax > CCH SureTax > Sales > CCH SureTax Sales Setup.

- Select options for the following fields in the General section:

- Update order lines. Select an option to indicate whether changes made to CCH SureTax settings at the order level should flow to the line item level.

- Update misc. charges. Select an option to indicate whether you want changes made to CCH SureTax Sales settings at the order header or line item level to automatically flow to the corresponding miscellaneous charges.

- Select options for the following fields in the Order Defaults section:

- Tax Exemption Code. Select a default Tax Exemption Code. This value defaults into the order-header settings but can be overridden on the Dynamics 365 Customers form.

- Tax Exemption Reason Code. Select a default tax exemption reason code. This value defaults into the order-header settings but can be overridden on the Dynamics 365 Customers form.

- Regulatory Code. Select a default regulatory code from the list. The option you select here will default for order-header settings, but can be overridden on the Dynamics 365 Customers form. The options listed here vary depending on which data packages have been purchased with the main CCH SureTax application.

- Sales Type code. Select a default sales type from the list. The option you select here will default for order-header settings, but can be overridden on the Dynamics 365 Customers form.

- Transaction Type Code. Select a default transaction type from the list. The option you select here will default for order-header settings, but can be overridden on the Dynamics 365 Released Products, Category Hierarchy, Main Account, Books, Fixed Asset, or Charges form.

- Tax Situs Rule. Select the default Tax Situs Rule.

- Unit Type Code. (Displays only if the industry is Communications or Utilities.) Select the default Unit type code.

- Select options for the field in the Free Text Invoice field:

- Update line address. Select an option to indicate whether changes made to CCH SureTax settings at the order level should flow to the line item level.

- Select Enable Plug-in for Sales and Project. The default is always Disabled.

- No SureTax plugin code will execute when plugin is disabled for a module.

- Select Use Invoice Account. If enabled, Invoice account will be sent to SureTax for Invoice proposal instead of Project contract customer account.

- Select Disable CCH SureTax Settings for Credit Notes. If true, Suretax settings for Credit Note and Return Order are not enabled. Default is always true.

- Select Copy settings from SQ to SO functionality. If set to false, the CCH SureTax setup values will be copied from Sales Quotation to Sales Order. If set to true, CCH SureTax copy settings will be disabled and the Sales Order will be created with default settings, it will behave as a new Sales Order. Default is always false.

- Select Compliance Date.It will send the compliance month and year to SureTax based on the option selected. Default is set to Blank.

- Currect date - takes the current system date.

- Document date - takes the document date of the transaction.

- Invoice date - takes the invoice date of the transaction.

- Delivery date - takes the requested shipped date of the transaction.

- When no compliance date is selected it will take the date from calculation date type selected in the general ledger parameter.

- Select Retainnage mode for Invoice proposals. Default is set to Full Amount Minus retainage

- Full Amount Minus Retainage. This value calculates tax on the line amount minus the amount that is being retained by the customer.

- When the retained amount is invoiced using the Release Retained Amount feature, the original line that had some retainage will be sent to SureTax with the amount retained as the revenue instead of the Fee line values.

- Full Amount. This value calculates tax on the line amount even if some of it is being retained by the customer.

- When the retained amount is invoiced using the Release Retained Amount feature, no tax calculation call will be made to SureTax.

- Select Disable Header Level Ship To Address for Sales and Projects. If enabled, Header level address will be send as blank to SureTax. Default is always Disabled.

- Select the Default enable tab and select the following, as applicable:

- Sales quotation. Select this option if you want CCH SureTax to calculate sales tax on the Sales quotation form. Clear this option if you do not want CCH SureTax to calculate the sales tax on the Sales quotation form.

- Free text invoice. Select this option if you want CCH SureTax to calculate sales tax on the Free text invoice form. Clear this option if you do not want CCH SureTax to calculate the sales tax on the Free text invoice form.

- Sales order. Select this option if you want CCH SureTax to calculate sales tax on the Sales order form. Clear this option if you do not want CCH SureTax to calculate the sales tax on the Sales order form.

- Invoice proposal. Your selection will default into the SureTax Sales Setup form for this customer. If you leave this value blank, the default from the Sales Setup form will be used.

- Project quotation. Select whether CCH SureTax should calculate tax on Project quotation for this project.

- On the sales forms line setting tab, select the Ship to options, SKU Table, SKU Field, and Transaction type option for the lines on each sales form:

- Sales Order

- Sales order header line misc. charge

- Sales order line item

- Sales order line misc. charge

- Free Text Invoice

- Free text invoice line

- Free text Invoice misc. charge

- Sales Quotation

- Sales quotation header misc. charge

- Sales quotation line item

- Sales quotation line misc. charge

- Invoice proposal

- Invoice proposal expense line item

- Invoice proposal fee line item

- Invoice proposal header misc. charge

- Invoice proposal hour line item

- Invoice proposal item line item

- Invoice proposal line misc. charge

- Invoice proposal on-account line item

- Project quotation

- Project quotation expense line item

- Project quotation fee line item

- Project quotation hour line item

- Project quotation item line item

- Enter an address on the Default ship-to address tab.

- Do the following in the Default ship-from address tab:

- Select the Customer's warehouse box if the default ship-from address should be the customer's warehouse.

- Enter an address in the Default ship-from address section. This address will be used when no customer warehouse address is available.

- Click Save.

Setting SureTax Options on the Microsoft Dynamics 365 Forms

When you install CCH SureTax for Microsoft Dynamics 365, the plug-in adds sales tax settings to several standard forms in Microsoft Dynamics 365. The table below lists Accounts Receivable forms that receive additional settings from the plug-in. It also shows where these settings affect the sales tax calculation.

| Microsoft Dynamics 365 Module Name | Microsoft Dynamics 365 Form | CCH SureTax Fields Added to Microsoft Dynamics 365 Form | Transactions Affected by CCH SureTax Settings |

|---|---|---|---|

| Customers | Sales quotation enable. Overrides the CCH SureTax Sales quotation enable option for the selected Customer. | ||

| Sales order enable. Overrides the SureTax Sales order enable option for the selected Customer. |

|

||

| Free text invoice enable. Overrides the CCH SureTax Free text invoice enable option for the selected Customer. | |||

| Sales Type code. Overrides the default CCH SureTax Sales Type code option for the selected Customer. | |||

| Tax Exemption Code. Overrides the CCH SureTax default Tax Exemption Code option for the selected Customer. | |||

| Tax exemption reason code. Overrides the CCH SureTax default Tax exemption reason code option for the selected Customer. | |||

| Invoice proposal enable. Overrides the CCHSureTax Invoice proposal enable option for the selected Customer. |

|

||

| Project quotation enable. Overrides the CCHSureTax Project quotation enable option for the selected Customer. |

|

||

| Released Products | Transaction Type Code. Overrides the default CCH SureTax Transaction type option at the order line level for the selected Released Products. |

|

|

| Accounts Receivable | Tax Situs Rule. Overrides the default CCH SureTax Tax Situs Rule option at the order line level for the selected item. | ||

| Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. | |||

| Sales Category | Transaction Type Code. Overrides the default CCH SureTax Transaction type option at the order line level for the selected Sales Category. |

|

|

| Tax Situs Rule. Overrides the default CCH SureTax Tax Situs Rule option at the order line level for the selected Sales Category. | |||

| Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. | |||

| Main Account | Transaction Type Code. Overrides the default CCH SureTax Transaction type option at the order line level for the selected account. |

|

|

| Tax Situs Rule. Overrides the default CCH SureTax Tax Situs Rule option at the order line level for the selected account. | |||

| Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. | |||

| Fixed Asset | Transaction Type Code. Overrides the default CCH SureTax Transaction type option at the order line level for the selected account. |

|

|

| Tax Situs Rule. Overrides the default CCH SureTax Tax Situs Rule option at the order line level for the | |||

| Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. | |||

| Books | Transaction Type Code. Overrides the default CCH SureTax Transaction type option at the order line level for the selected account. |

|

|

| Tax Situs Rule. Overrides the default CCH SureTax Tax Situs Rule option at the order line level for the | |||

| Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. | |||

| Charges Code | Sales quotation enable. Overrides the CCH SureTax Sales quotation enable option for the selected charges code. | ||

| Sales order enable. Overrides the SureTax Sales order enable option for the selected charges code. |

|

||

| Free text invoice enable. Overrides the CCH SureTax Free text invoice enable option for the selected charges code. | |||

| Transaction Type Code. Overrides the default CCH SureTax Transaction type option at the order line level for the selected charges code. | |||

| Tax Situs Rule. Overrides the default CCH SureTax Tax Situs Rule option at the order line level for the selected charges code. | |||

| Tax exemption reason code. Overrides the CCH SureTax default Tax exemption reason code option for the selected Customer. | |||

| Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. | |||

| Terms of delivery | Freight on board. Specify the CCH SureTax freight on board option to be used associated with a Dynamics 365 delivery term. |

|

|

| Modes of delivery | Common Carrier. Specify the CCH SureTax delivery by option to be associated with a Dynamics 365 mode of delivery. |

|

|

| Unit Form | Unit Type Code. Overrides the default CCH SureTax Unit type code at the order line level for the unit type. |

|

|

| Project Category | Transaction Type Code. Overrides the default CCH SureTax Transaction type option at the order line level for the selected Project Category. |

|

|

| Tax Situs Rule. Overrides the default CCH SureTax Tax Situs Rule option at the order line level for the selected Project Category. | |||

| Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. |

The procedures that follow contain instructions for setting configuration options on the Dynamics 365 forms listed in the preceding table.

Setting SureTax Options for a Customer on the Dynamics 365 Customer Form

Use the following procedure to choose the CCH SureTax options for specific Dynamics 365 customer accounts. The CCH SureTax options that can be modified for a customer are the Sales quotation enable, Sales order enable, Free text invoice enable, Invoice proposal enable, Sales Type code, Tax Exemption Code, and Default Transaction Type.

- Select the Accounts Receivable menu in the Microsoft Dynamics 365 Navigation Pane.

- Navigate to the Customer Details form for any customer.

- Click the CCH SureTax fast tab.

- In the SureTax section, select the following options. If any of these options are left blank, the default is used:

- Sales quotation enable. Your selection will default onto the SureTax Sales Setup form for this customer. If you leave this value blank, the default from the Sales Setup form will be used.

- Sales order enable. Your selection will default onto the SureTax Sales Setup form for this customer. If you leave this value blank, the default from the Sales Setup form will be used.

- Free text invoice enable. Your selection will default onto the SureTax Sales Setup form for this customer. If you leave this value blank, the default from the Sales Setup form will be used.

- Invoice proposal enable. Your selection will default onto the SureTax Sales Setup form for this customer. If you leave this value blank, the default from the Sales Setup form will be used.

- Sales Type code. Your selection will override the default Sales type selected on the SureTax Sales Setup form for this customer.

- Tax Exemption Code. Your selection will override the default Tax Exemption Code selected on the SureTax Sales Setup form for this customer.

- Tax exemption reason code. Your selection will override the default Tax exemption reason code selected on the SureTax Sales Setup form for this customer.

- Transaction Type Code. Select the default Transaction Type Code to be used for this customer.

- Tax Situs Rule. Select the default Tax Situs Rule.

- Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item.

- Close the form to save your changes.

Setting Sales Tax Options for a Product on the Dynamics 365 Released Products Form

Use the following procedure to override the CCH SureTax options for specific Dynamics 365 Released Products. The Transaction Type CCH SureTax option can be modified for the Released Products.

- Select the Product information management menu in the Microsoft Dynamics 365 Navigation Pane.

- Navigate to Common > Released products.

- Select an item and click Edit on the action pane.

- On the Released products form, expand the CCH SureTax tab and select the following options:

- Transaction Type. Your selection will override the transaction type selected on the transaction forms. If left blank, the header level selection defaults for Released Product on transactions.

- Tax Situs Rule. Your selection will override the default Tax Situs Rule selected on the transaction forms. If left blank, the header level selection defaults for Released Products on transactions.

- Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. If left blank, the header level selection defaults for Released Products on transactions.

- Close the form to save your changes.

Setting Sales Tax Options for Sales Category on the Dynamics 365 Category Hierarchy Form

Use the following procedure to override the CCH SureTax options for specific Dynamics 365 Sales Category. The Transaction Type CCH SureTax option can be modified for the Sales Category.

- Select the Sales and Marketing menu in the Microsoft Dynamics 365 Navigation Pane.

- Navigate to Setup > Categories > Sales categories.

- On the Sales categories form, click Edit category hierarchy.

- On the Category hierarchy form, expand the CCH SureTax tab and select the following options:

- Transaction Type. Your selection will override the transaction type selected on the transaction forms. If left blank, the header level selection defaults for sales category on transactions.

- Tax Situs Rule. Your selection will override the default Tax Situs Rule selected on the transaction forms. If left blank, the header level selection defaults for sales category on transactions.

- Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. If left blank, the header level selection defaults for sales category on transactions.

- Close the form to save your changes.

Setting Sales Tax Options for a Miscellaneous Charge Code on the Dynamics 365 Charges Code Form

Use the following procedure to override the CCH SureTax options for specific Dynamics 365 Charges Codes. The Transaction Type CCH SureTax option can be modified for the Charges Codes.

- Select the Accounts Receivable menu in the Microsoft Dynamics 365 Navigation Pane.

- Navigate to Setup > Charges > Charges code.

- On the Charges code form, expand the CCH SureTax tab and select the following options in the SureTax defaults section.

- Sales quotation enable. Your selection will default on to the SureTax Sales Setup form for this customer. If left blank, the default is used.

- Sales order enable. Your selection will default on to the SureTax Sales Setup form for this customer. If left blank, the default is used.

- Free text invoice enable. Your selection will default on to the SureTax Sales Setup form for this customer. If left blank, the default is used.

- Invoice proposal enable. Your selection will default on to the SureTax Sales Setup form for this customer. If left blank, the default is used.

- Transaction Type. Your selection will override the Transaction type selected on the transaction forms. If left blank, the header level selection defaults for charges on transactions.

- Tax Situs Rule. Your selection will override the default Tax Situs Rule selected on the transaction forms. If left blank, the header level selection defaults for charges on transactions.

- Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. If left blank, the header level selection defaults for charges on transactions.

- Close the form to save your changes.

Setting Sales Tax Options for a Main Account on the Dynamics 365 Main Accounts Form

Use the following procedure to override the CCH SureTax options for specific Dynamics 365 Main Account form. The Transaction Type CCH SureTax option can be modified for the Main account.

- Select the General ledger menu in the Dynamics 365 Navigation Pane.

- Navigate to Common > Main accounts > Main accounts.

- Select a main account and click Edit on the action pane.

- On the Main account form, expand the CCH SureTax tab and select the following option:

- Transaction Type. Your selection will override the Transaction type selected on the transaction forms. If left blank, the header level selection will default for Main Account on transactions.

- Tax Situs Rule. Your selection will override the default Tax Situs Rule selected on the transaction forms. If left blank, the header level selection will default for Main Account on transactions.

- Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. If left blank, the header level selection defaults for Main Account on transactions.

- Close the form to save your changes.

Setting Sales Tax Options for a Fixed Asset on the Dynamics 365 Fixed Assets Form

Use the following procedure to override the CCH SureTax options for specific Dynamics 365 Fixed Assets. The Transaction TypeCCH SureTax option can be modified for a Fixed Asset.

- Select the Fixed Assets menu in the Microsoft Dynamics 365 Navigation Pane.

- Navigate to Common > Fixed Assets > Fixed assets.

- Select a fixed asset and click Edit on the action pane.

- On the Fixed assets form, expand the CCH SureTax tab and select the following options:

- Transaction Type. Your selection will override the Transaction type selected on the transaction forms. If left blank, the header level selection will default for Fixed Assets on transactions.

- Tax Situs Rule. Your selection will override the default Tax Situs Rule selected on the transaction forms. If left blank, the header level selection will default for Fixed Assets on transactions.

- Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. If left blank, the header level selection defaults for Fixed Assets on transactions.

- Close the form to save your changes.

Setting Sales Tax Options for a Book on the Dynamics 365 Book Form

Use the following procedure to override the CCH SureTax options for specific Dynamics 365 Books. The Transaction Type CCH SureTax option can be modified for a Book.

- Select the Fixed Assets menu in the Microsoft Dynamics 365 Navigation Pane.

- Navigate to Common > Fixed Assets > Fixed assets.

- Select a fixed asset and click Books > Books on the action pane.

- On the Books form, select the CCH SureTax

- Transaction Type. Your selection will override the Transaction type selected on the transaction forms. If left blank, the header level selection will default for Book on transactions.

- Tax Situs Rule. Your selection will override the default Tax Situs Rule selected on the transaction forms. If left blank, the header level selection will default for Book on transactions.

- Regulatory Code. Overrides the default CCH SureTax Regulatory Code option at the order line level for the selected item. If left blank, the header level selection defaults for Book on transactions.

- Close the form to save your changes.

Setting SureTax Options for a Unit

To select CCH SureTax settings for a unit, do the following:

- Navigate to any Unit form.

- Select the CCH SureTax tab.

- In the Order defaults section, select the options for this unit.

- Close the form to save the CCH SureTax settings for the unit.

Setting Options on the Dynamics 365 Mode of Delivery Form

When tax is calculated on an order, the Common carrier option that is associated with the selected mode of delivery is sent to CCH SureTax. Use the following procedure to set the CCH SureTax Common carrier option for each mode of delivery that has been set up in Microsoft Dynamics 365.

- Select the Sales and Marketing menu in the Microsoft Dynamics 365 Navigation Pane.

- Navigate to Setup > Distribution > Modes of delivery.

- On the Mode of delivery form, select a delivery mode.

- Expand the CCH SureTax tab on the right hand pane.

- Select the option in the Common carrier field.

- Close the form to save your changes.

Setting Options on the Dynamics 365 Delivery Terms Forms

When tax is calculated on an order, the Freight on board option that is associated with the selected delivery term is sent to CCH SureTax. Use the following procedure to set the CCH SureTax Freight on Board option for each delivery term that has been set up in Microsoft Dynamics 365.

- Select the Sales and Marketing menu in the Microsoft Dynamics 365 Navigation Pane.

- Navigate to Setup > Distribution > Terms of delivery.

- On the Terms of delivery form, select a delivery term.

- Expand the CCH SureTax tab on the right hand pane.

- Select a Freight on board option.

- Close the form to save your changes.

Using the Sales Component

Selecting Sales Tax Options for a Sales Order or a Sales Quotation

You can set CCH SureTax options at the sales order or sales quotation level, or you can set sales tax options for individual line items, depending on your needs. Keep in mind the following when you make changes to the options on a sales order or sales quotation:

- Order-level or quotation-level changes override defaults from the SureTax Sales Setup form.

- Order-level or quotation-level changes override any custom selections that were made on the Microsoft Dynamics 365 Customer form.

- Line item changes override selections made at all other levels, including order-level or quotation level changes and changes made on the Customer form.

Setting Sales Tax Options at the Sales Order or Sales Quotation Level

By default, new sales orders and quotations will use the sales tax options that are selected in the SureTax Sales Setup form. Use the procedure below to select different options for a specific sales order or sales quotation.

- Select the Accounts Receivable menu in the Microsoft Dynamics 365 Navigation pane.

- Navigate to Common > Sales orders > All sales orders.

- Open the Sales Order Details or Sales Quotation Details form.

- Create new or select an existing sales order or quotation for which you want to set sales tax options.

- On the Sales order form, click the SureTax Setup button.

- Select Sales Order. The SureTax Setup form for Sales order form displays.

- Select the following CCH SureTax options for the sales order or quotation:

- Enable. Select this option if you want CCH SureTax to calculate sales tax for this order or quotation. Clear this option if you do not want CCH SureTax to calculate the sales tax.

- Sales Type Code

- Regulatory Code

- Tax Exemption Code

- Select multiple exemption codes from the exemption code field by selecting multiple codes from the drop down list.

- Tax Exemption Reason Code

- Transaction Type Code

- Tax Situs Rule. Select the Tax situs rule for the Sales Order or Quotation. When a Tax situs rule of 7 is selected, the Primary and Secondary ZIP Code fields will display.

- Primary ZIP Code. Enter the Primary ZIP Code for the sales order or quotation.

- Secondary ZIP Code. Enter the Secondary ZIP Code for the sales order or quotation.

- Unit Type Code (Displays only if the industry is Communications or Utilities.)

- Close the CCH SureTax Setup form to save the changes.

Setting Sales Tax Options at the Line Item Level for a Sales Order or Sales Quotation

By default, new line items on a sales order or quotation will use the sales tax options that are selected on the Released products detail form, Category Hierarchy form, and order header for that order or quotation. You can use the procedure below to set different options for individual line items.

- Select the Accounts Receivable menu in the Microsoft Dynamics 365 Navigation pane.

- Navigate to Common > Sales orders > All sales orders.

- Open the Sales Order Details or Sales Quotation Details form.