General Overview

Welcome to the API documentation for the CCH SureReturns system! This comprehensive documentation will guide you through creating and filing tax forms in real time using our REST APIs. By submitting web request/response messages via Internet services, you can seamlessly integrate with our system and streamline your tax filing processes.

The CCH SureReturns API equips developers with a powerful toolkit to interact with our system programmatically. With our RESTful architecture, you can effortlessly create, retrieve, update, and delete tax forms, all in real time. Our API adheres to industry-standard practices, ensuring seamless integration and compatibility with a diverse range of programming languages and frameworks. By leveraging our API, you can significantly enhance your tax filing processes, making them more efficient and streamlined.

This documentation provides detailed information on accessing and authenticating with our REST APIs. We will walk you through the necessary steps to set up your integration, including instructions on obtaining API credentials, generating access tokens, and securing your requests using HTTPS.

We have provided a comprehensive list of available endpoints, each representing a specific functionality within the CCH SureReturns system. You will find the HTTP method, endpoint URL, required parameters, and example request and response payloads for each endpoint. This will enable you to understand the structure of the API calls and effectively utilize the available resources.

We have included code examples and step-by-step tutorials to assist you in implementing everyday use cases. These examples will guide you through the process of creating and filing tax forms, showcase the various functionalities of our API, and provide a starting point for your integration.

Additionally, we have included best practices and guidelines to help you optimize your integration. These recommendations cover error handling, pagination, rate limiting, and data validation, ensuring a robust and efficient integration with our system.

If you encounter any challenges or have queries during the integration process, our dedicated support team is here to assist you. Please get in touch with the CCH Support team at 800-739-9998, Chat at http://support.cch.com/chat/corpsystemsalestax, or raise a web ticket at https://support.cch.com/ticket/

Getting Started

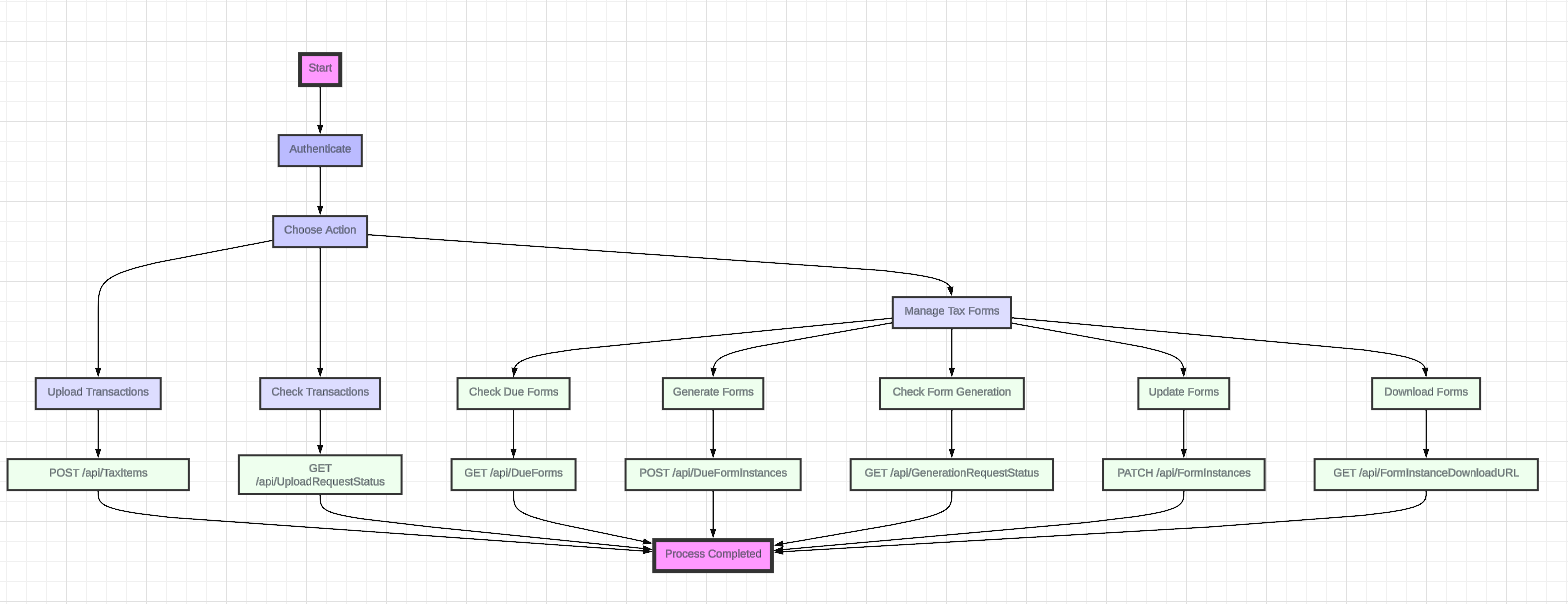

To begin using the CCH SureReturns API, follow these steps:

1. Obtaining an Access Token:

The access token is required for authentication and authorization in subsequent API calls.

Locate the "Access Token endpoint" in the API collection provided. This endpoint contains all the necessary values to retrieve the access token using the OAuth2 protocol.

Request the access token endpoint, providing the required credentials and parameters.

Upon successful authentication, you will receive an access token in the response.

2. Using the Access Token:

Once you have obtained the access token, you must include it in the authentication header for all subsequent API calls.

Set the "Authorization" header in your API requests using the "Bearer" scheme followed by the access token. For example: "Authorization: Bearer {access_token}".

3. Upload Transactions:

With the access token, you can now upload your transaction file using the "POST/TaxItems" endpoint.

Refer to the API documentation or collection for the specific endpoint details, including the URL and HTTP method.

Include the access token in the "Authorization" header of the API request to authenticate your upload.

Provide the necessary parameters, such as the file to be uploaded, in the request body.

Upon successful upload, you will receive a response confirming the status of the transaction file.

4. Check the Upload Status

The "GET/Upload Request Status" endpoint is designed to check the status of the uploaded transactions. Refer to the API documentation or collection to find the endpoint.

5. Check the Tax Forms that are due for submission

The "GET/DueForms" endpoint allows users to retrieve a list of tax forms scheduled for submission based on their entity's specific configuration settings. This endpoint provides essential information about the forms, such as their due dates, tax authority information, and any additional information. By utilizing this endpoint, users can efficiently manage their tax obligations and ensure timely compliance with regulatory requirements.

6. Create new Tax Forms

The "POST/DueFormInstances" endpoint enables users to automatically generate new tax forms for submission based on the due forms. This endpoint utilizes the due forms data and dynamically creates the necessary tax forms in the required format. The endpoint then generates the appropriate forms with accurate information and prepares them for submission. This functionality streamlines the process of generating tax forms, ensuring accuracy and efficiency in meeting submission deadlines.

7. Check whether the forms were generated

The "GET/GenerationRequestStatus" endpoint allows users to check the status of the tax forms generated through the generation request. This endpoint provides real-time information about the progress and status of the form creation job. Users can retrieve details such as the current processing status, errors or warnings encountered during generation, and the completion status of the job. Users can track the progress of their generated forms by utilizing this endpoint.

8. Check the status of the tax forms

The "GET/FormInstances" endpoint allows users to check the status of the tax forms generated by the generation job. This endpoint provides information about the filing status of the individual tax forms and retrieves details such as format and size.

9. Update Tax Form status

The "Patch/FormInstances" endpoint is designed to facilitate setting different filing statuses for tax forms once generated. This endpoint allows users to edit, provide approvals for electronic submissions, and perform other necessary updates to the generated forms. Users can specify the form identifier, the desired filing status, and any additional information or modifications required. The endpoint then processes the update request and applies the specified changes to the form's filing status. This functionality enables users to manage and track the progress of their generated forms, ensuring accurate and timely submissions with the appropriate approvals in place.

10. Download forms

The "GET/FormInstanceDownloadURL" endpoint allows users to download the generated tax forms. This endpoint provides a mechanism for retrieving the generated forms in a downloadable format, such as PDF or XML. This endpoint allows users to view and verify if the forms were generated correctly, ensuring accuracy and completeness before submission. This functionality enables users to make necessary changes or adjustments to the generated forms, ensuring compliance with regulatory requirements and minimizing errors.